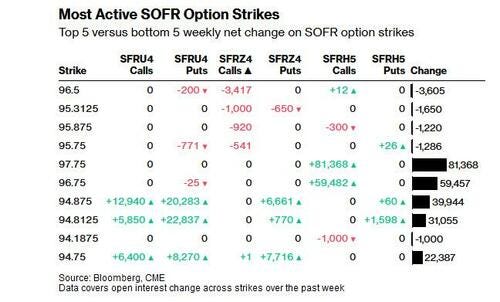

As Bloomberg reports, there has been a large bet placed in the SOFR (Secured Overnight Financing Rate) option market. The MAR25 96.75/97.75 call spread is betting that the Federal Reserse would cut the funds rate by at least 300 bps by March 14, 2025.

Open Interest in both strikes increased 106,201 and 112,496, respectively. The SOFR call spread has been bought over the course of three sessions for a total of $13m in premium paid.

While the bet would max. profit with the funds rate near 225 bps, the Fed-dated OIS for the March ‘25 meeting is only pricing in 76 bps of rate cuts.

It's unknown when the Fed will begin to cut, but what we do known is it's always late. I do agree, somewhat, with Powell that the Fed is restrictive. It almost seems obtuse yo say such a thing. One would look at equities and financial conditions then say otherwise. However, I have talked about the mechanical processes that take hold in the equity market.

When looking at Europe, China, Japan, etc., it becomes clear why money flows into U.S. equity markets. It also must be understood that credit spreads still remain “stubbornly” tight. It's all a confidence game.

There are key indicators suggesting that the Fed is nearing a cut. I've talked about the labor market, but let's go over some things I went over in “Ghosts of 2018 Haunt With QT Looming” which remains one of my most popular notes.

Prior to every major tightening cycle the US 2y yield peaks, and we generally see yields across the curve do so as well several months out from a rate cut. The 3m yield (highly linked to monetary policy) stabilizes and peaks. This has occured.

I talked about this more in depth here.

The we begin to see US real yields peak and rollover, which they are doing now. This effectively allows inflows into rate sensitive assets like bonds, gold and bitcoin. Generally, this is deemed bullish and not a sign of what's to come. Commodities will rise, and this will play on the heart strings of gold bulls even though gold is inversely correlated with volatility.

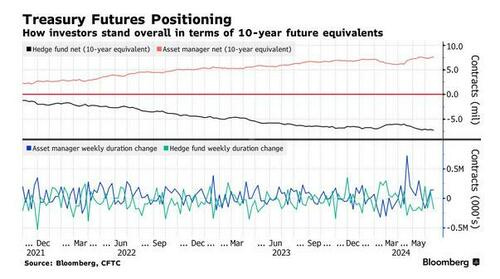

If the US 2y yield peaks before the Fed cuts rates, and bids when a cutting cycle is underway, you can clearly see that volatility increases - not decreases - during cut cycles. In fact, volatility doesn't begin to revert until the trough in the YoY change in the fund rate is in.

“Fed Pause Is A Psychological Bull Trap”

Inflation breakevens are stagnating and not suggesting a resurange in inflation.

The TMB Rate Sensitive proxy is bottoming, and that's given me reason buy the “Powell Pivot” basket of gold, bonds and bitcoin. You can even through in the QQQ.

However, I allocate on a risk adjusted basis and overweight bonds and underweight bitcoin and equities until I see that trough in the funds rate YoY and volatility begins to mean revert.

Share this post