"...because two percent is an absolute fantasy, and they're never going to verbalize the new target is actually three (percent)" - Thomas Hayes

The above quote is by Great Hill Capital's Thomas Hayes while on David Lin's podocast on July 2. Of course, Hayes is talking about the Fed's imaginary two percent inflation target that has been largely adopted by global central banks.

Here, I talk about when it's employment- not inflation - that matters most to the Fed.

There's this growing conspiracy that Jay Powell is secretly targeting an above-two percent rate of inflation vis-a-vis the personal consumption expenditures (PCE) data set.

The worry is that the Fed will be “unexpectedly” forced to cut rates with inflation hovering in the high-2% or 3s, depending on your data set favorite.

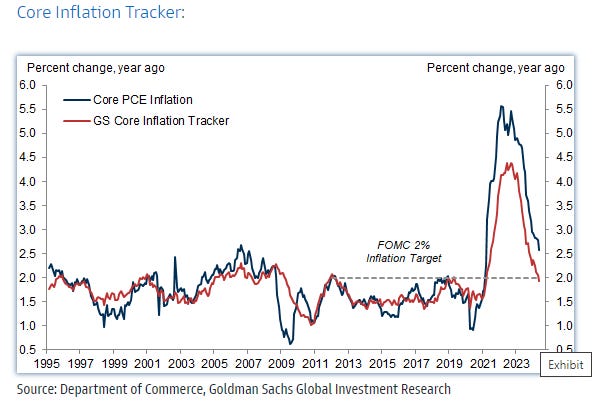

The official core PCE print is just above 2.5% YoY while Goldman Sachs’ core inflation tracker is sub-2% The issue is whether it's CPI, core CPI, super-duper core, PCE etc. it all doesn't matter.

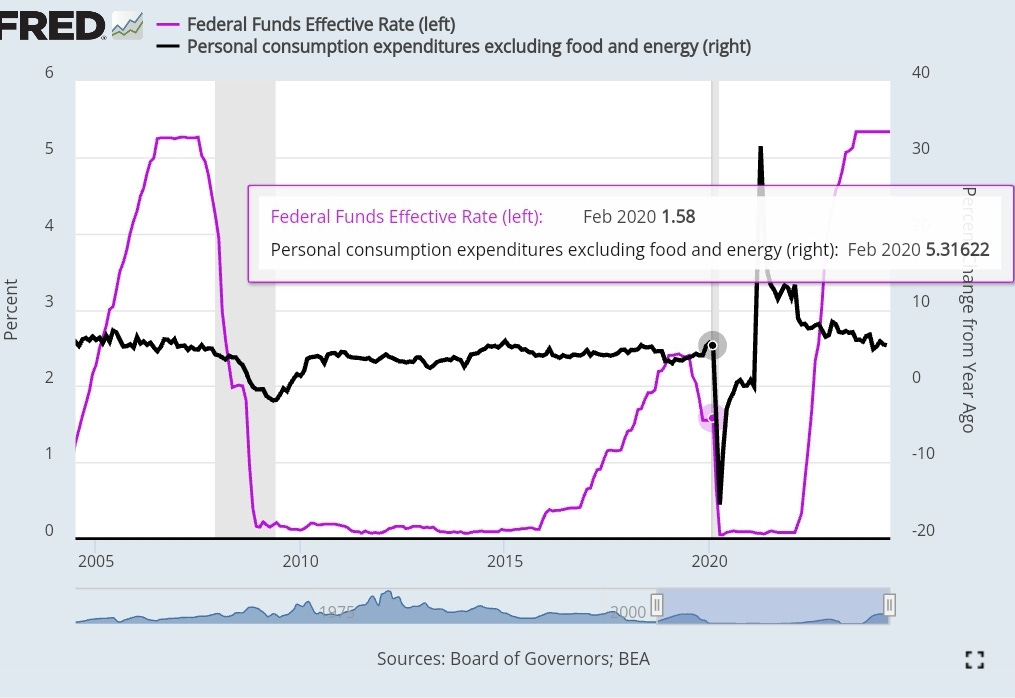

Why? Fed never needed sub-2% in any inflation metic to begin cutting rates. Core PCE has never been below 2% before the Fed began to cut in modern times.

Share this post