Chinese Financial Stress Mount With Banks Failing On Bad Loans, U.S. CPI Cools

Forget Inflation, It's About Employment Pt. II

Forget Inflation, It's About Employment; Recession of Revisions

Non-Farm Payrolls Remain A Distraction, Unemployment Rule Trifecta

Bonds Spooked as Yen Heads To Our Target

Huge Bet On Fed Rate Cuts Hit As Signs Pile Up

Note: I misspoke in regards to core PCE. Current PCE is 2.7%, not but PCE was 5.3% in 2019. Core PCE was just above 2% My apologies.

Are rate cuts bullish? Of course not, silly goose.

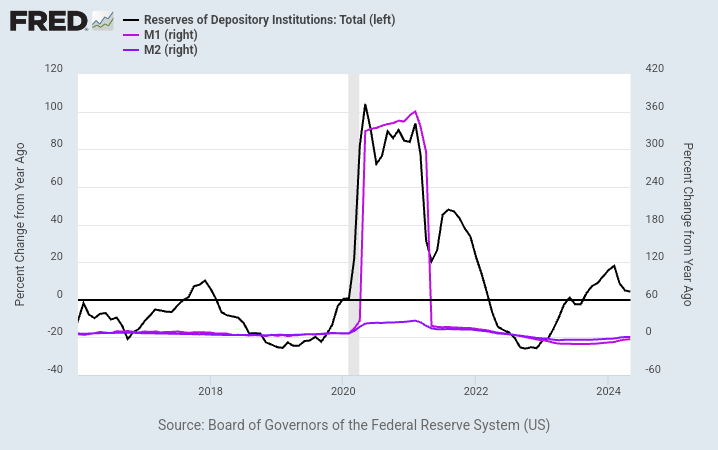

Two charts I found interesting. They incorporate bank reserves, M1 and M2 YoY during both Volcker and Powell's tenure. Many don't know that under Volcker's attempt to crush Inflation, financial instutions were under a lot of stress.

Volcker cranked the money supply dramatically higher in order to provide liquidity to the financial sector. The Fed, under Volcker, blew through their M1 & M2 targets.

Stress seems to occur once reserves contract YoY.

Stress under Powell first occured in late 2018, forcing him to flip, and it remained throughout 2019 when he was forced to cut rates.

Again, when reserves contracted in late ‘22/early ‘23, we had a string of bank failures starting with Silicon Valley Bank. Powell then lessened their targeted quantitative tightening. QE introduces reserves into the system. QT takes reserves out of the system.

Reserves may be on their way to contracting again, but this relationship hold some water as we've recently seem modest uptick in money aggregates.

Despite banks passing the Fed's stress test, stress remains evident.

Share this post