Quantitative tightening (QT) unofficially started yesterday but does not go into effect June 15th as the first round of asset purchases mature and roll off the Fed's balance sheet.

The Ghosts of 2018 haunt Fed Chair Jay Powell, who will now oversee both the 2018 and current round of QT. As many of you know, Q4-18 was one to remember as a blood bath is risk assets commenced.

Effectively, with the combination of interest rate hikes and balance sheet reduction, the Fed drove financial conditions sharply higher in 2018 causing credit issuance to freeze in Q4-18. The junk debt market froze for over 40 days, and this led to the famous “Powell Pivot” in December 2018; and Powell went from hawkish to dovish on a dime.

The backdrop is similar in some sense, but different in others. Similarly, there was a reflation push globally with risk assets, commodities and yields pushing higher as the Fed embarked on their tightening cycle. Financial conditions and real yields were low, and the monetary tightening gently pushed those higher.

However, unlike 2018, we’re not coming off the back of a global synchronized recovery. In some sense, the world rebounded, uniquely, from a post-pandemic slowdown, but much of the growth was led by simply allowing everyone return to everyday activities with sporadic injections of fiscal support.

Moreover, China is not climbing out of a recession but likely in one now. Europe is not far behind, and the economic data for the U.S. is quickly decelerating - as I said it would.

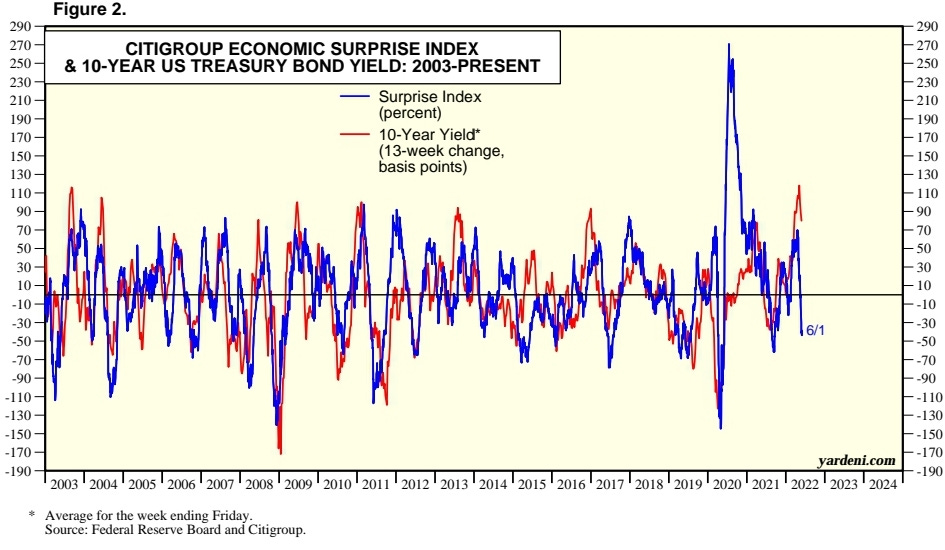

The Citi Economic Surprise Index, which measures economic data versus consensus estimates is now sharply negative (i.e. data is worse than forecasts).

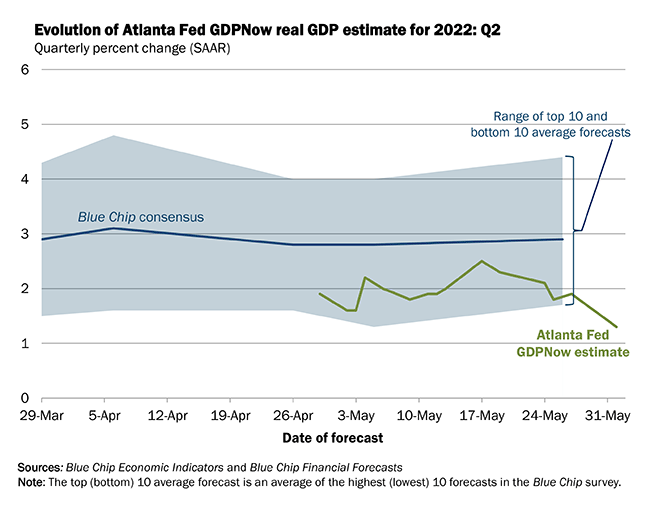

This is supportive of the advanced Q1-22 GDP print of -1.5% and the ever-declining Atlanta Fed GDPNow nowcast of 1.3%, down 32% week-over-week.

Notice the blue chip consensus. Nobody is expecting a another negative quarter.

So, Powell is tightening monetary policy into a global economic slowdown. This is a key distinction.

Yesterday, the Bank of Canada (BoC) hiked their key benchmark rate by 50 bps to 150 bps. When the BoC hikes rates, they hike rates on Canada. When the Federal Reserve hikes rates, they hike on the entire world as the de facto global central bank.

Before I get into more detail, what is quantitative easing (QE)?

Customer deposits enter the commercial banking system, and the bank can either lend the deposits out or buy interest baring securities, such as treasuries, mortgage-backed securities (MBS), or, potentially, high-yield securities.

The Fed creates bank reserves (not legal tender) and swap those treasuries or MBS securities for bank reserves on the bank's balance sheet.

This is what the laymen refer to when they say “The Fed prints money,” and they would be incorrect. Bank reserves are not money, cannot be spent and is merely an accounting placeholder.

The idea behind this is that with a bank's balance sheet “freed up” it would then go out into the real economy and lend to consumers (that’s the actual money printing).

The Fed facilitates but does not print money. That actually matters.

Over the last year, banks have increased their lending and reduced their purchasing of interest baring securities. Because banks are flush with deposits, whatever is not lent out or used to purchase securities is then parked at the Fed using the reverse-repurchase program (RRP).

This is like a synthetic monetary tightening because excess desposit are taking out of the banking system and parked at the Fed in exchange for treasuries, and this is how bank’s fund themselves and their interest-baring accounts.

Quantitative tightening (QT) is set up differently than in 2018. First, instead of directly selling the treasuries and MBS off their balance sheet, the Fed will allow maturing securities to simply mature and roll off the balance sheet.

The aim is to not overwhelm the financial markets as many of these securities on the balance sheet were purchased years ago and are “off the run” with little demand or liquidity.

As these securities mature and roll off, the Treasury will pay the Fed face value of the Treasury bond or MBS, and that money will go back into the banking system as customer deposits.

The monthly cap is set at $47.5B per month (versus $50B per month in 2018), but then will increase to a cap of $90B per month in September.

This is why whispers of a Fed pause (ceasing hiking rates for time being) by Atlanta Fed Bank President Bostic in September or late second-half were murmured.

Why? Each month of QT equates to a 25 bps hike on the funds rate. In September, it’ll be as if the funds rate increases 50 bps per month.

That is to say that regardless of whether the Fed continues to hike rates, QT will be a de facto tightening and push financial conditions higher.

In “So Long 2021! What’s Poppin’ In Q1-22,” I wrote that the Fed will perfer to utilize QT over rate hikes. The funds rate is virtually meaningless but followed by everyone. It’s a communication tool, nothing more.

Financial conditions and yields began moving higher in December before the Fed even begain to hike. If needed, the Fed could pause hiking and give the impression of pausing tightening while allowing QT to pushing financial conditions higher in the background.

The following exclusive charts and commentary on QT, credit and bonds are for Macro Strategist Pro members. Sign up for 25% off now!