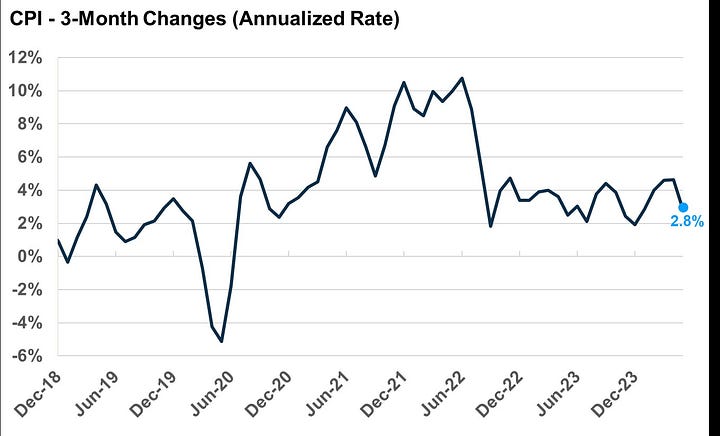

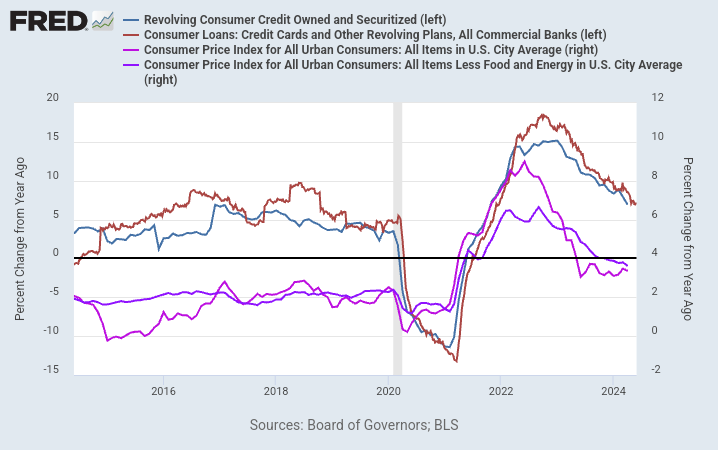

Yesterday was an interesting day, and it really underpinned the morning note about market participants not being able to price the Fed's policy path. On one hand, the consumer price index came out cooler than expected; and equities ramped higher in the premarket as Fed policy expectations loosened. This continued until the FOMC press conference where Jay Powell was much more hawkish then expected.

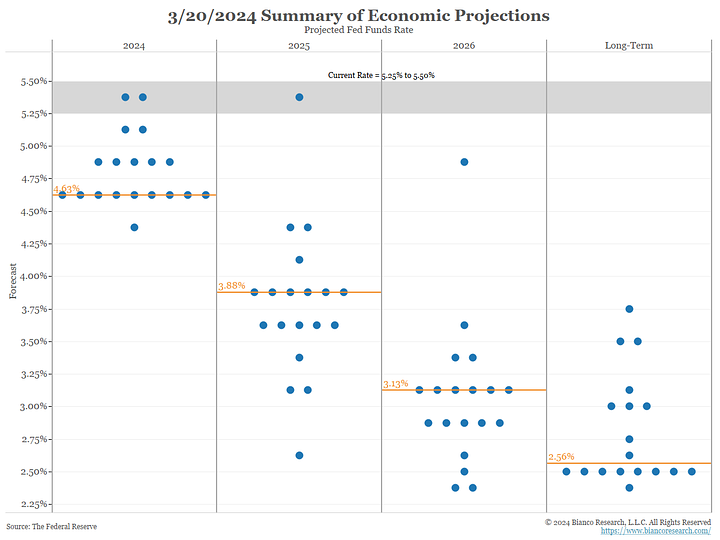

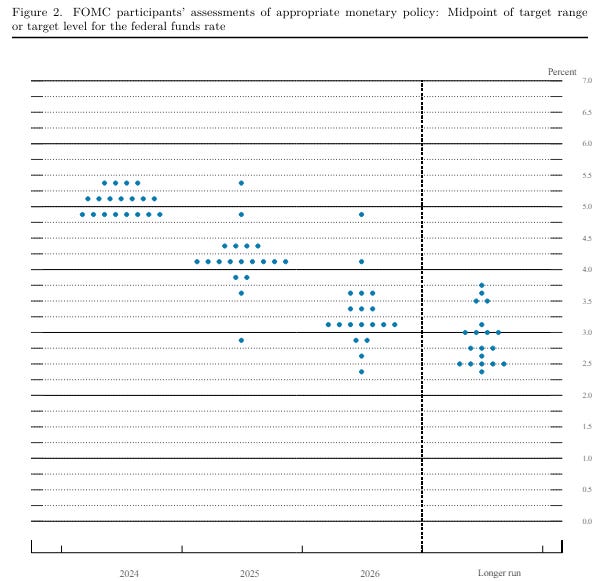

Fed holds rates at 5.25% to 5.5% The Fed Signals just one cut of 25 bps in 2024 vs 75 bps.

The Median 2024 Core PCE inflation estimate is up to 2.8% vs 2.6% The Median forecast shows 100 bps cut in 2025 vs 75 bps

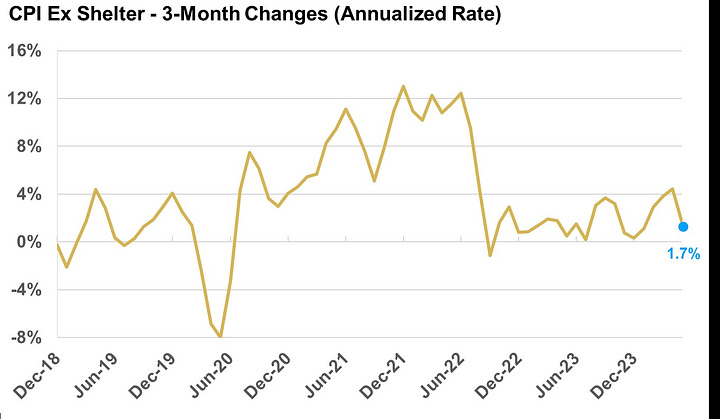

May CPI came in below all estimates at 3.3% YoY and 0.0% MoM. The suddenness of the slowdown is shocking, really. The supercore CPI (i.e. services ex-shelter) was actually in deflation at -0.04%, in large part due to auto insurance falling from 1.8% MoM to -0.1% A big eyesore in the consumer data has been the rapid increase in auto insurance.

Auto insurance rates increasing have been largely due to rising car prices. More to insure bigger, the premium. Used car prices have fallen and insurance rates will follow - same goes for the housing sector.

With OER being such a lagging data point, up to three years, it does make since by putting it to the side.

The lower CPI also underlines how weak the economy is with prices falling in non-essentials like clothing and electronics. Some may say well that's great... the stuff I need to live is still expensive.

Look, fair enough. But this is how recessions start. Non-essential goods fall off as money gets tight. Consumers are refocusing their cash to food, gas and housing. That's not a growing economy.

The PPI came in as I'm writing with a massive, I mean massive print. Concensus was .3% MoM down from .5% PPI came in at zero, yes zero. Down .2% month-over-month. Amazing. It's really showing how off base the inflation camp is.

This is why I mentioned in yesterday's note on why were can expect CPIs to start coming in softer. The economy slowing has been putting downward pressure on commodity prices.

This is why for the last month I've been short copper and oil. I think precious metals are overpriced here but that's another story. I've also had a few notes explaining why I'm long bonds and began reaching out for duration in May.

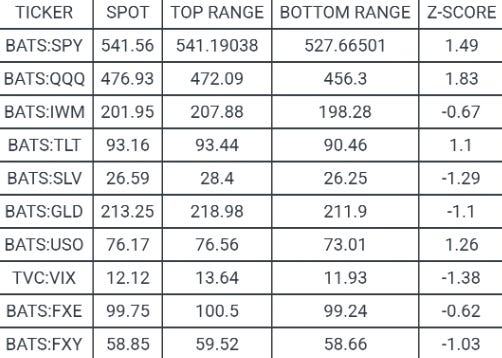

TLT has been up 4% since May. It is definitely not Nvida but there's a method to the madness. The QQQ can be a high beta arm of the Powell Pivot basket. When it comes down to it: it's all a rates trade.

Quick question: when did the 30 year yield top? Back on April 14. What was April 14? The day prelim GDP for Q1 came out 1.6% from 3.4% in QQ4. It's advanced (second of three prints) print was revised lower to 1.3%

We now are in an environment of slowing growth and slowing inflation. Wait until these PPI numbers filter into CPI.

Stocks are up big again premarket. They can't and won't see the Forrest for the trees. The flows are all that matters.

Everyone is so focused on the Fed cutting they are bypassing the fact that we're heading for recession. I

Initial claims came in at 242k, a 20k beat on expectations. And this is with the U3 rising point 6% over the last six months.

Near-term trading ranges:

Share this post