The Macro Brief: Higher Volatility Regime As Equities Underperform Seasonality

Expect 2025 to be volatile headwind for equities after a huve 2024.

Market participants should start positioning for a higher volatility regimes in 2025 after collecting 25%-plus returns from equities last year as more uncertainty between growth/inflation expectations and Fed policy remain.

Even though we saw the largest single-day increase in the VIX on Aug. 6, and a large spike in volatility heading into the end of the year, markets remained quite optimistic.

Historically, volatility tends to be episodic. There's a large spike in volatility that is almost always sold as buying opportunities arise in the chaos. However, when you combine near-record lows in cash positioning, deteriorating breadth ontop of elevated risk expoaure, and uncertainty, we can start to envision a trending volatility regimes that settles in the mid-to-higher 20s on the VIX (mean 19.55).

We're also seeing VIX/VIX3M and VIX/VIX6M trend higher. I went over the importance of this implied volatility ratio in the substack chat, but both are trending higher which is inherently bearish equities.

In early and mid-December, I talked about reaching out for insurance against equity positioning prior to the end-of-year blow-out in the VIX which was great timing, but in “Could Risk Assets Capsize In Q1-25?” I went over particular scenarios where we can see pressure on equity markets, including a “growth scare.”

So far so good, but markets can trade themselves into a position where a relief rally does occur before heading lower.

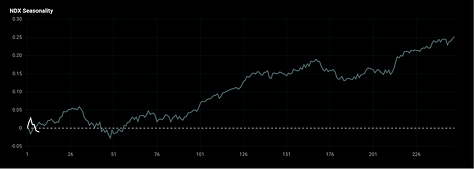

The SPX and NQ are both underperming their seasonal strength with VIX outperforming. I expect some strength heading into the end-of-the-month before rolling over again.

Occasionally, I'll get shit for being seemingly too bearish on equities, but I'm risk managing both positions and expectations. Overall markets simply do not sniff out the subtle shifts in the underlying data that catch them off kilter. I'm just a man writing out my thoughts - take it or leave it. I'm fine with that.

Below, I'll get into:

• Gamma update

• Revist: Equities to Capsize In Q1-25

• IG & HYG spreads

• Treasury/Corporate Spreads