Could Risk Assets Capsize In Q1-25?

Both institutional and retail investors are historically long risk. It won't take much for a pullback.

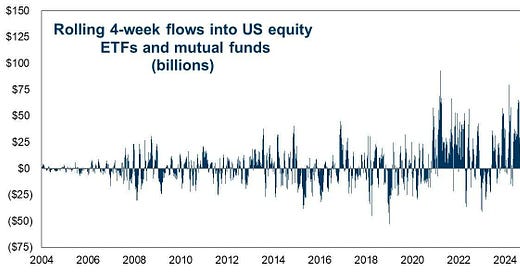

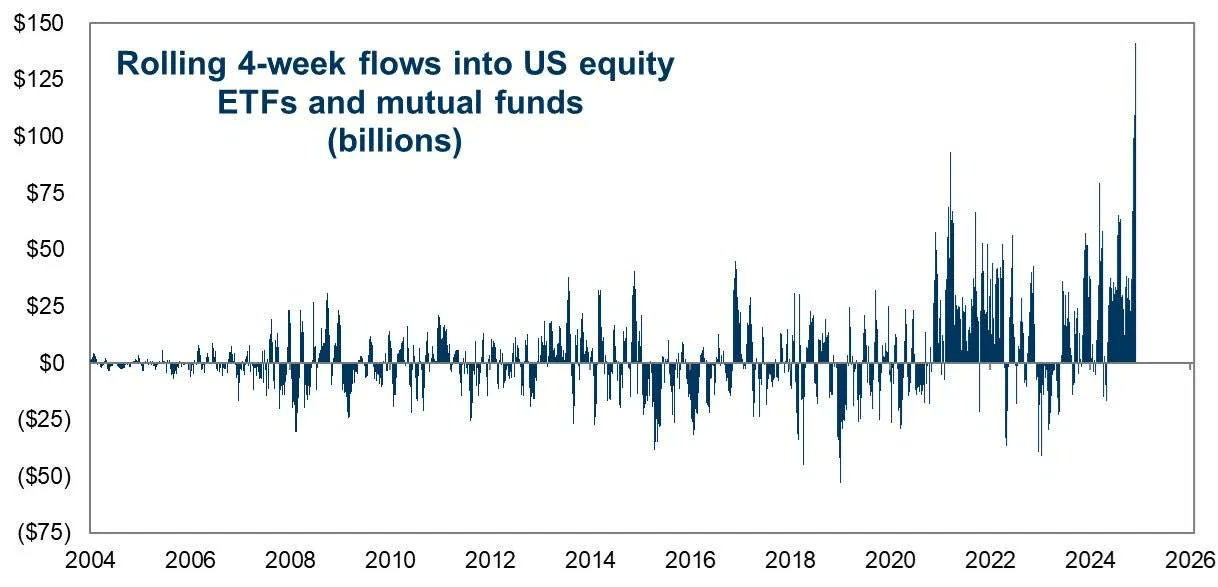

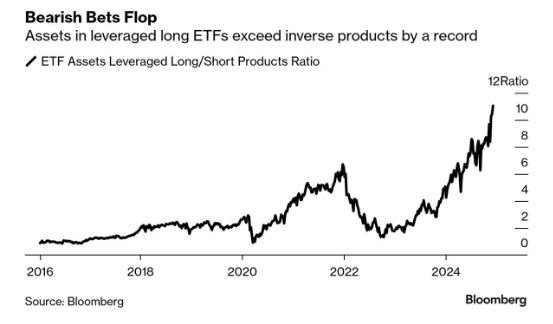

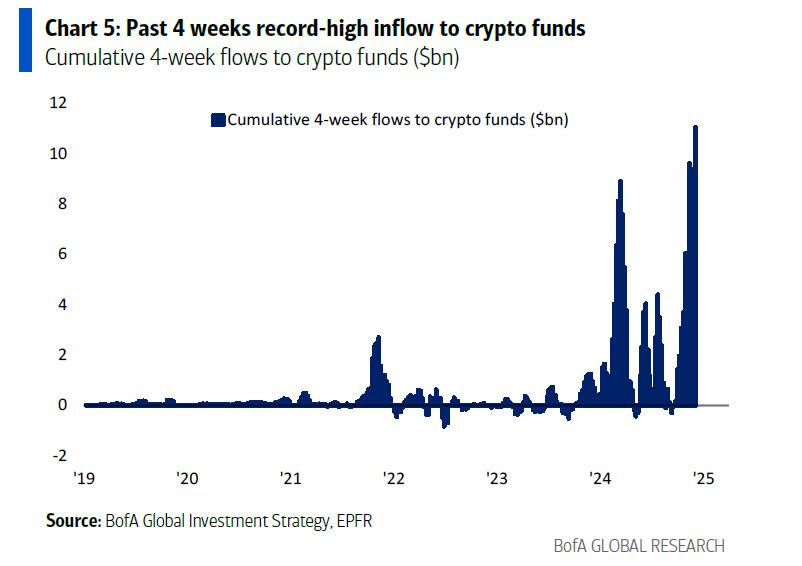

Is a pullback brewing in risk assets? Following a week of all-time high inflows in everything from crypto funds to leveraged ETFs, could the market be ready to sell in Q1-25?

December is seasonally bullish for risk assets, and Nik outlined that here. We seen a return of memecoin mania (now fading) with bitcoin's epic run to $100,000. U.S. equities ran to all-time highs, and it's igniting FOMO (fear of missing out) once again.

All-time high inflows into leveraged ETFs v Inverse ETFs

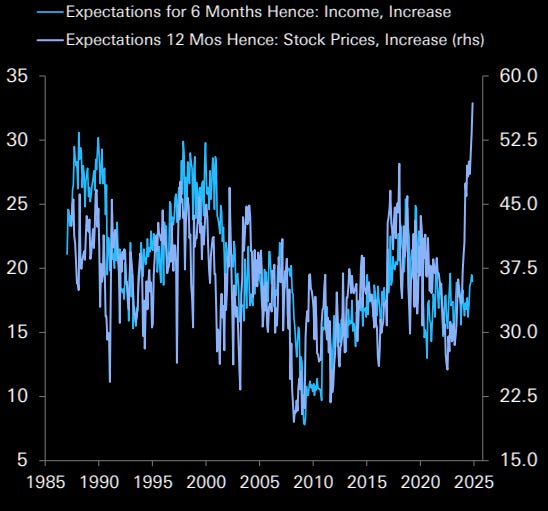

And sentiment is following through with retail investors, known for their perfect timing.

Expectations of higher asset prices: