FOMC Day: Powell To Tilt Dovish Into 2025, Guidance Over Telegraphed Cuts

What could Powell hint at heading into 2025.

Heading into the telegraphed 25 bps cut, its forward guidance that could catch markets off guard heading into 2025. Moreover, in my opinion, the ongoing quantitative tightening (QT) will remain the elephant in the room as the Fed’s Jay Powell will dance between optimistic and dovish.

The liquidity reducing tightening of QT has been quite substantial and far exceeds that of the last Powell underwent QT in 2018.

The Fed's balance has been in contraction since late 2022, and, currently, contracting 10.9% YoY.

Initially, $90b in treasuries would roll off the Fed balance sheet. This was a key distinction from the 2018 QT cycle where the Fed actively sold treasuries to reduce the balance sheet.

Nevertheless, removing the Fed as a liquidity buffer has causing numerous issues in the form of higher interest rates and prolonged grinding in terbank dynamics. After several banks failed, most notably Silicon Valley Bank, Powell reduced QT from $90b to a “poultry” $25b. However, in the background, it remains ongoing; and that's how Powell likes it.

Because despite market forces obsessing over the funds rate, this matters more, in my opinion. It's unlikely that Powell will address QT - out of sight out of mind (for the markets) - unless the press directly questions him about it.

There will be more focus on the blip up in consumer prices which Powell will remain “optimistic” that the blip is - need I say - transitory.

In reality, Powell is far more concerned with the direction of employment and how hiring is anemic.

I wrote about this here:

Forget Inflation, It's About Employment; Recession of Revisions

Forget Inflation, It's About Empliyment Pt. II

The Recession of Revisions Is Growing Suggests The Philly Fed, Idea Updates

Side note: since June, my “defensive” picks of Walmart (WMT) and Costco (COST) are up 42% and 15%, respectively.

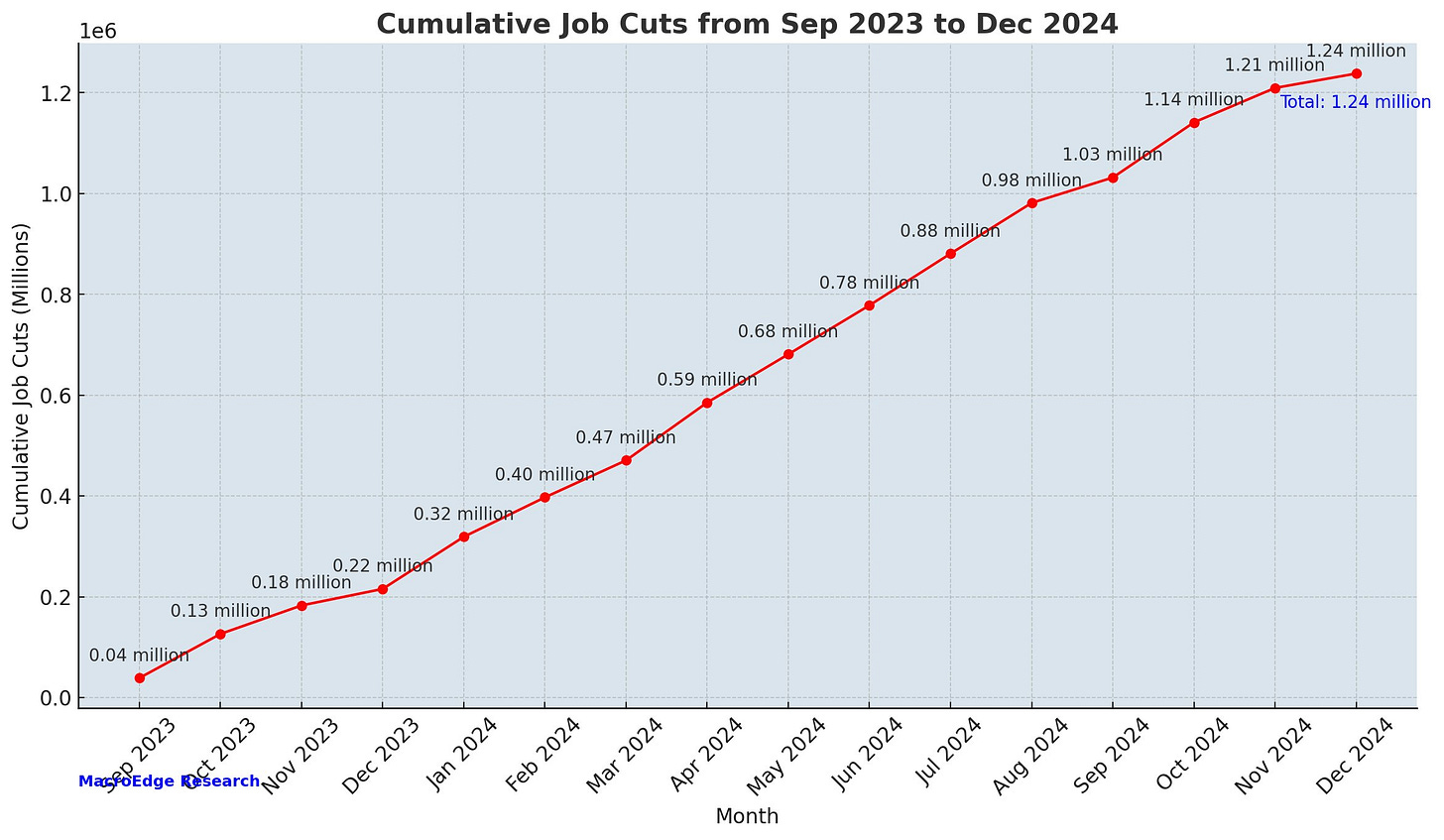

The Philly Fed recently came out with an update for 2023 and 2024 payrolls showing that, in 2024, 1.02m jobs were revised off the books. That number swells to 1.24m Sept 2023.

I've wrote several notes on the lack of hiring in the U.S. New job postings on Indeed.com, a far higher latency data point than the JOLTs, shows that we're nearing the depths of the Covid crisis. We went from not enough workers to too many.

The tightening in the oversupply in workers has a negative effect on wages. Through growing at 3.9% YoY for nonsupervisory average weekly wages, employers were willing to raise wages to meet their demands. The post- and pre-Covid gap has closed.

The Indeed job postings, like real-time shelter prices, is in the front of Jay Powell's mind as he's quoted both metrics in previous FOMC pressers. He's even gone as far as to criticise government data sources.

So, as he dances that line between his obligation to express the state of the economy through rose-colored glasses, there are numerous reasons why he'll continue to cut into 2025 with employment being in the front of the line.

The U3/U6 rate spread is a great way of determine the slack in the labor market, and that slack often determines the path of the Fed cutting cycle.

The U3 unemployment rate is the headline figure we receive every month, and the U6 unemployment rate is that of those working part-time for economic reasons (i.e. they cannot find full-time work).

This will anger many, but if the Fed were to cut to help facilitate the labor market, they should have done so in 2022 - when I've pointed out the U.S. economy began to deteriorate.

On top of the poor hiring more broadly, new graduate unemployment rate nearing 6% (nearly 2% the official U3 rate).

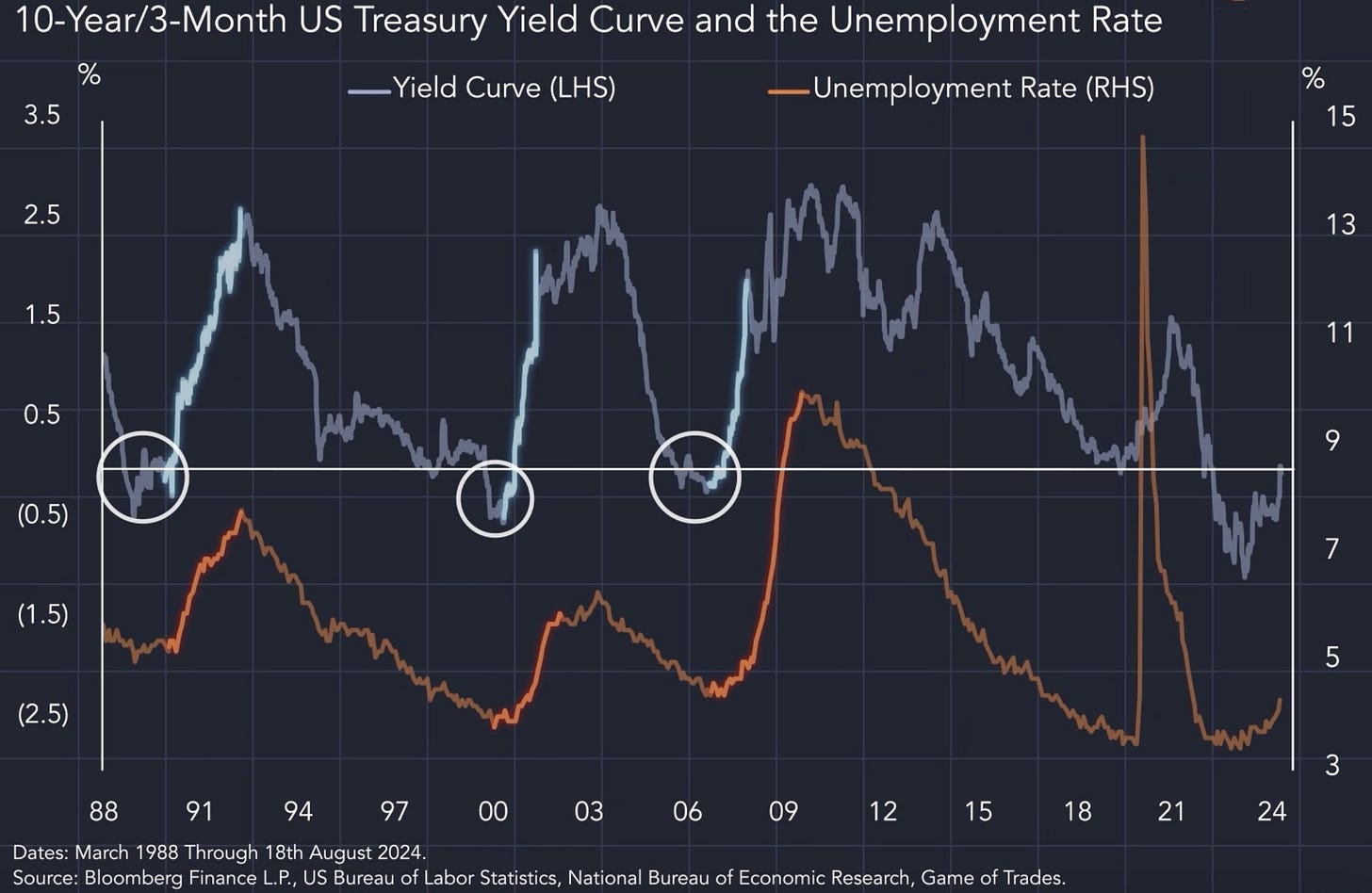

Maybe it's different this time, but the steepening of the 10s3m yield curve suggests that unemployment will spike in 2025. Upon my estimation, we'll really begin to see issues between 50-75 bps.

Whether is businesses or the everyday consumer, employment will always supercede consumer prices because working part-time or not at all means no income. No income means defaults on liabilities which ripple throughout the economy.

We're already seeing default rates in credit cards and auto loans rivaling that of the 2008 crisis with a supposed healthy labor market.

The Fed is too tight.

Market pundits often look at stocks, bitcoin or fartcoin's surge as an indicator the Fed is too loose without understanding the outside influence of foreign capital flowing into dollar assets.

For the everday American, conditions are quite tight .

Here are the series high rejection rates for mortgage refinancing, credit cards and auto loans, according the the New York Federal Reserve Bank (NYFRB) CES survey:

The average rejection rate for auto loans increased by 0.4 percentage point to 11.4 percent in 2024, the measure’s highest rate since the start of our series in 2013.

The average rejection rate for mortgage refinance applications increased to a new series high of 25.6 percent in 2024 from 15.5 percent in 2023.

Voluntary account closures for any type of credit decreased to 13.9 percent in 2024 from 15.8 percent in 2023, marking a new series low.

The proportion of respondents experiencing lender-initiated account closures for any type of credit increased to a series high 7.4 percent in 2024 from 7.2 percent in 2023.

This will continue to rise in 2025.

Markets are currently pricing in 72 bps of cuts in 2025. They're now dovish enough.

Now, how will this affect assets? In general, a dovish Fed would help risk assets remain near record highs. However, I talked about what could capsize risk assets here.

Liquidity still remain a factor for treasuries.

I still remain primarily in T-bills with a little exposure in duration, but there are a few factors I would want to see before I start moving out into the long-end:

We need to see liquidity begin to move higher and supported by my rate sensitive proxy. Additionally, inflation breakevens need to start moving lower. The 5y inflation breakeven is currently pinned near 2.5% If that begins to move towards 2-2.25% it could send in some flows.

Also, we need to see money market rates drop from the 4.5%+ that they currently sit at. This will come with additional rate cuts, which will cause money to flow from money market funds and into treasuries.