US Housing Market Stumbles: Sharp Drop in Starts and Underwhelming Permits Signal Builder Caution

What It Means for Markets

Introduction

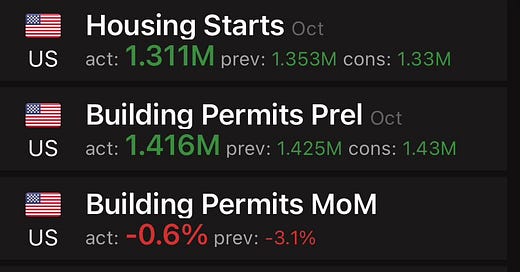

October’s housing data paints a sobering picture for the US real estate market. Housing starts fell by 3.1% month-over-month, far exceeding the prior month’s 1.9% decline, while building permits dipped by 0.6%, missing expectations. These figures highlight the growing strain on residential construction as mortgage rates remain near multi-decade highs, stifling buyer demand and pushing affordability to its limits. The data reflects a market navigating higher borrowing costs and subdued consumer sentiment, raising concerns about broader economic implications.

Housing Starts: Sharp Decline Points to Weakening Demand

The decline in housing starts to 1.311 million units (annualized) marks a sharp retrenchment in construction activity, signaling that builders are scaling back in response to weakening demand. This is the largest drop in recent months, reflecting both affordability challenges for buyers and builders’ cautious approach to managing inventory.

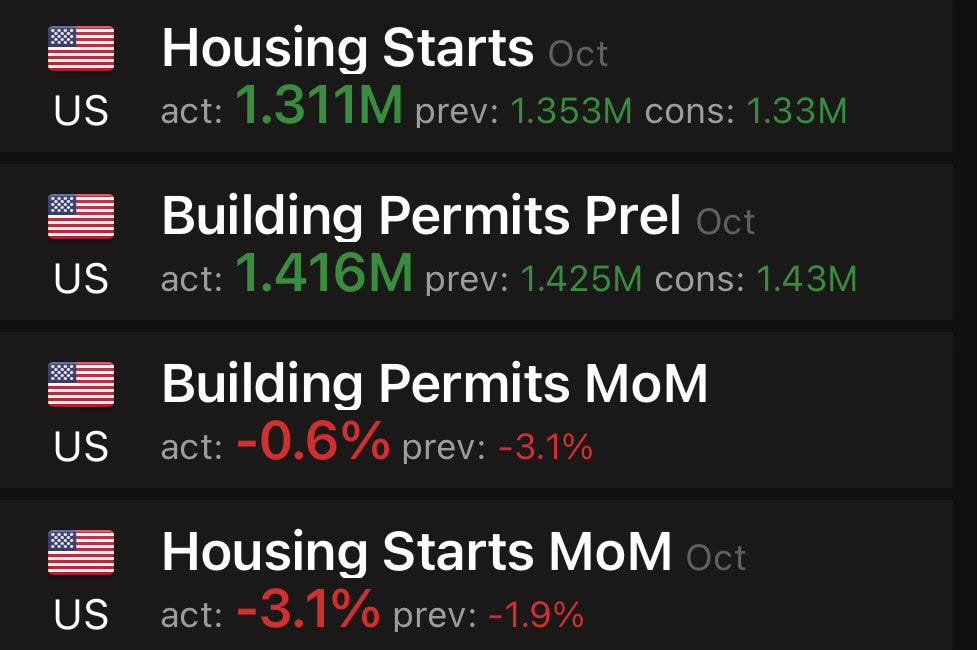

Housing Starts: A Five-Year Perspective

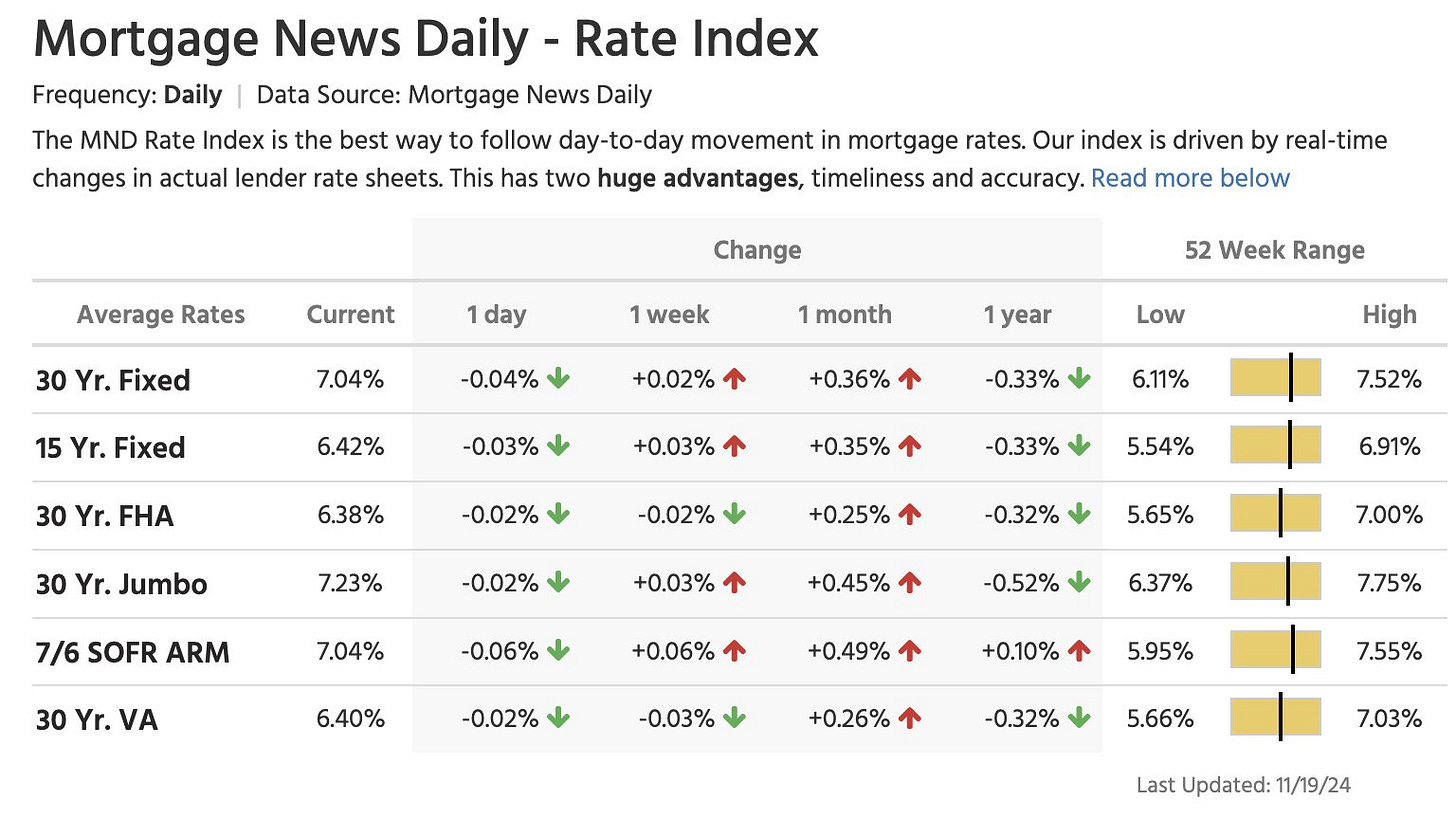

This chart shows the steep decline in housing starts over the past year, reversing gains made during the pandemic-era housing boom. The slowdown underscores how rising borrowing costs have derailed what was once a robust sector.

Builders, already contending with elevated material costs and labor shortages, are now facing fewer qualified buyers. Many prospective homeowners are priced out, leading to a notable pullback in activity, particularly in the single-family housing segment.

Building Permits: Glimmers of Stability?

Building permits, a leading indicator of future construction, declined by 0.6% MoM to 1.416 million units, falling short of expectations but moderating from September’s steeper 3.1% decline. The stabilization in permits suggests that some builders are cautiously optimistic about the medium-term outlook, potentially betting on rate relief or an uptick in buyer confidence.

Building Permits vs. Housing Starts

This chart highlights the divergence between current construction (housing starts) and forward-looking activity (building permits). While permits remain subdued, the slower decline relative to starts indicates that builders are preparing for a potential recovery once economic conditions improve.

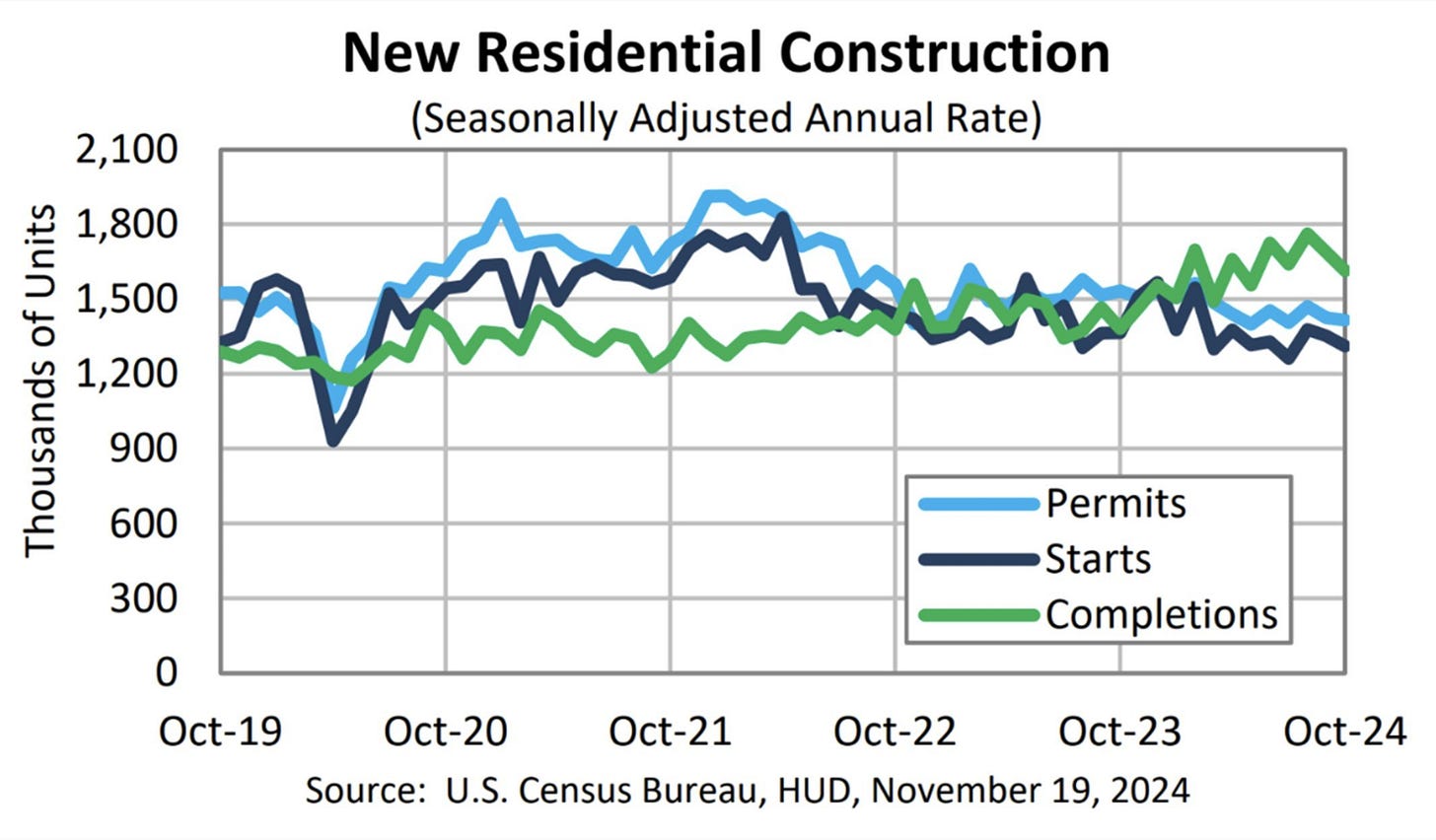

The Affordability Squeeze: Mortgage Rates Continue to Bite

The impact of surging mortgage rates remains the single largest headwind for the housing market. With the 30-year fixed rate now above 7%, monthly payments for the average homebuyer have doubled since 2020, significantly reducing housing affordability.

Mortgage Rates

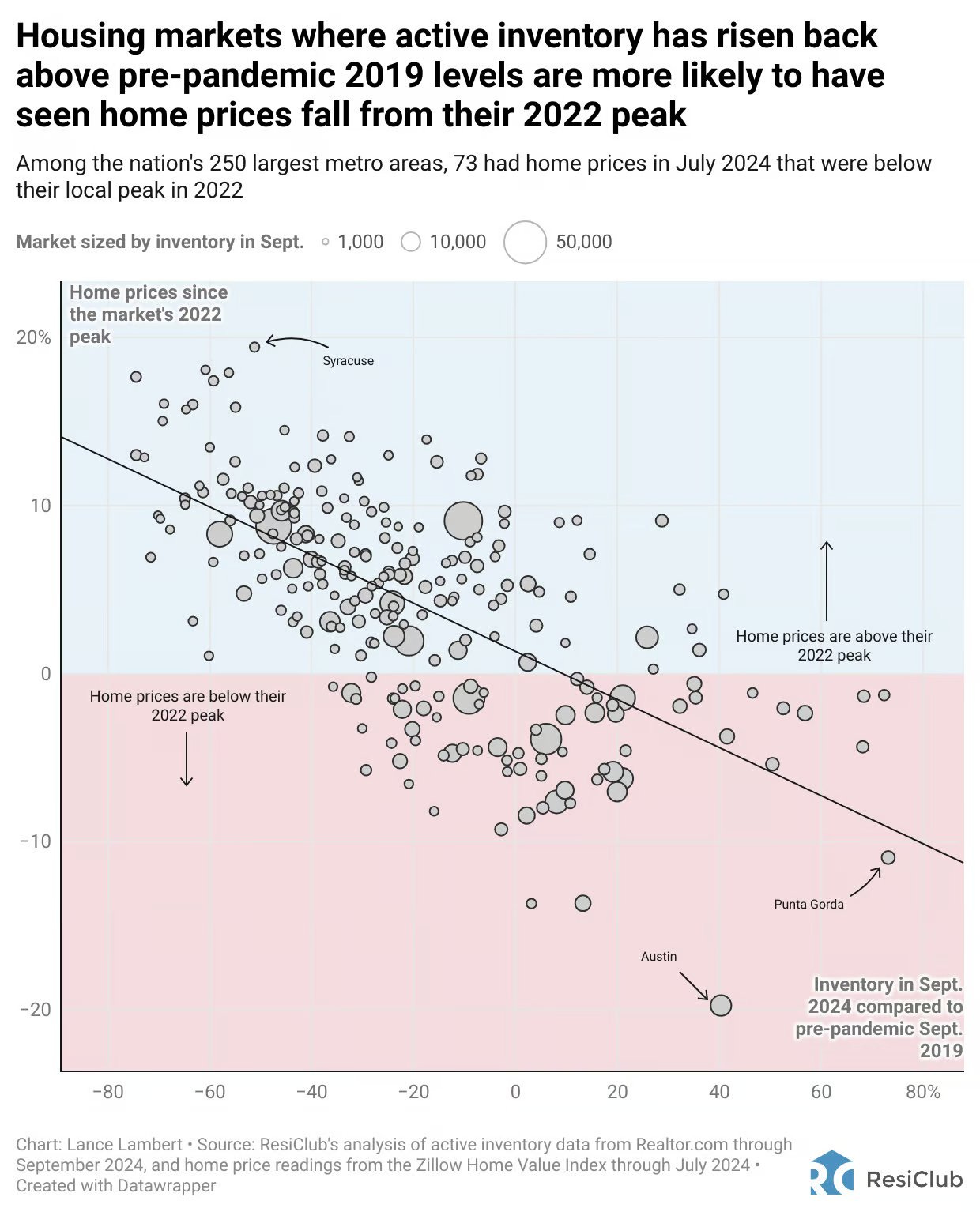

Tight Inventory Adds Complexity

One paradox of the current market is the persistent inventory shortage. Existing homeowners, locked into lower mortgage rates, are reluctant to sell, leading to constrained supply in the resale market. This has shifted demand toward new homes, even as builders hesitate to ramp up production.

Macro Implications: What This Means for the Economy

The housing market is often a leading indicator of broader economic trends. October’s data raises concerns about potential spillover effects into consumer spending, employment, and GDP growth.

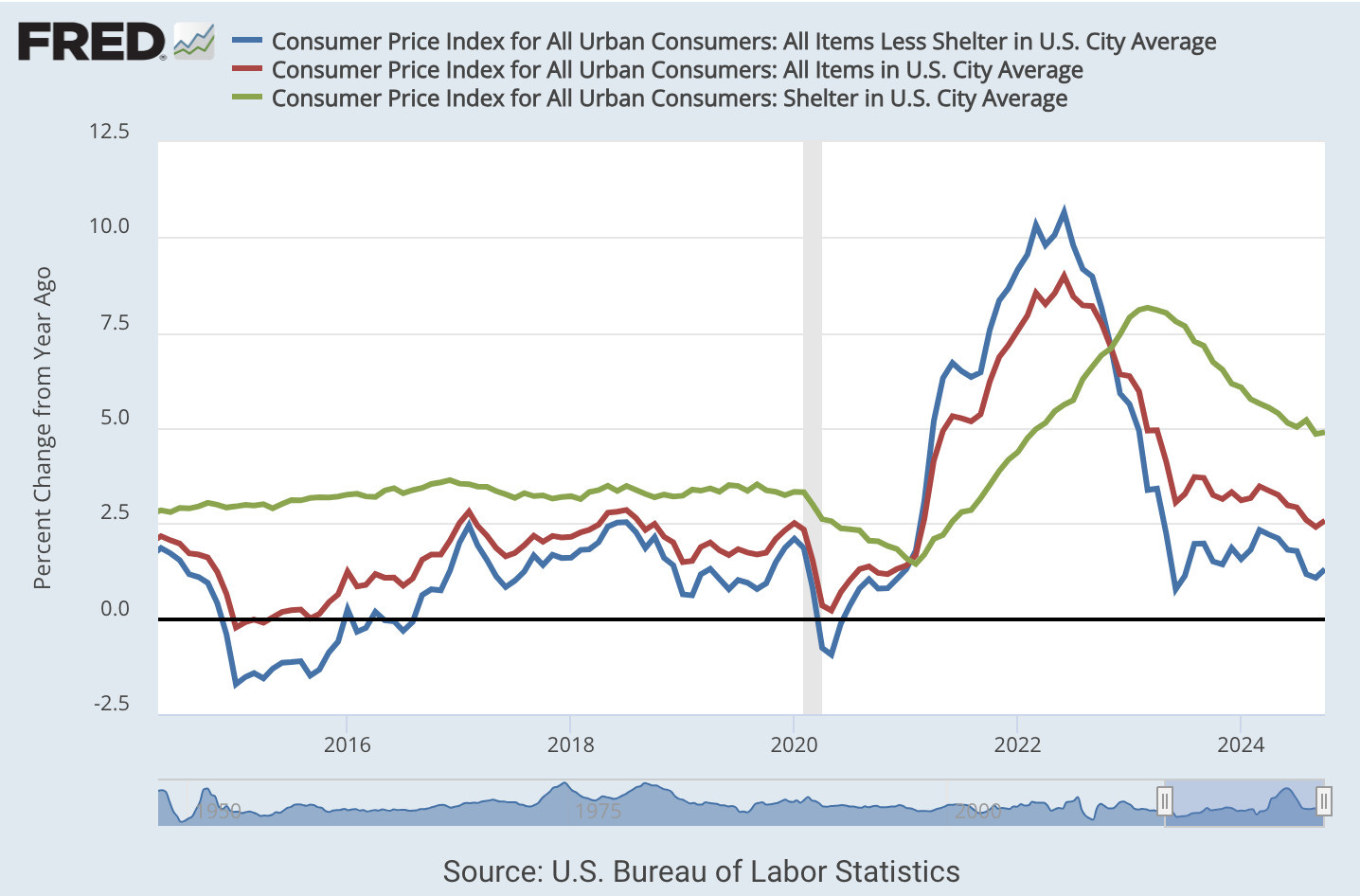

Inflationary Pressures:

Housing remains a significant driver of inflation, particularly through shelter costs in CPI. The moderation in starts and permits could signal slower growth in housing inflation, providing some relief for the Federal Reserve.

Shelter Inflation

A CPI chart that uses a private sector measure of shelter inflation showcasing the stickiness of shelter inflation.

Labor Market Sensitivity:

Residential construction is a key employer within the US labor market. A sustained slowdown in housing starts could lead to softer job growth in construction and related sectors, adding to broader economic pressures.Impact on Housing-Linked Equities:

Homebuilder stocks and related equities may face short-term headwinds given the weaker data. However, the relative stability in permits provides a potential silver lining, suggesting that the market may stabilize if mortgage rates retreat.

Looking Ahead: Is a Recovery Possible?

The trajectory of the housing market will depend heavily on macroeconomic conditions:

Mortgage Rates: Any significant drop in rates could ease affordability pressures, unlocking demand from sidelined buyers.

Policy Support: Federal or local incentives aimed at stimulating home construction or buyer assistance could help revive activity.

Consumer Sentiment: Confidence in the broader economy will be critical, particularly as inflation cools and labor market conditions remain stable.

Conclusion

October’s housing data underscores the challenges facing the US real estate market. While housing starts fell sharply, the slower decline in building permits suggests that builders are not entirely retreating from the market. For investors, the housing sector offers a nuanced picture: risks tied to affordability and demand are balanced by the potential for stabilization if economic conditions improve. As always, the housing market remains a bellwether for the broader economy, and the coming months will be pivotal in determining its path forward.