Two Mining Stocks To Buy & Hold Over 3-Yrs; Market Update

Here are two stocks I like to buy & hold for strong performance

Hope everybody has been able to manage recent volatility we're seeing across risk assets.

The VIX went from 14 to 21 in short order, and each vol selling event seemingly lasting less and less.

The two notes, I think, give a good overview of what I saw happening throughout Q1-25. It also outlines, then, that institutional investors were in the 98 %tile of equity exposure.

Fast forward to today, and we're seeing absolute record buying by retail investors while institutions are selling quickly, particularly in tech.

[12.11.24] - Could Risk Assets Capsize In Q1-25? - bit.ly/3ZOIMuL

[1.15.25] - The Macro Brief: Higher Volatility Regime As Equities Underperform Seasonality - bit.ly/40zWulE

On Jan. 8, I wrote about the attractiveness of duration with 30y yields at 5% on the substack chat. As luck would have it, TLT bottomed a week later and has been up 8% since.

It caught everyone off guard, but that tends to happen when the financial media landscape is very surface level. We're entering a new growth - really less growth - regime.

I talked about the impending growth scare below. The Atlanta Fed GDPNow has fallen from a high of 3.8% to 2.3% (lower once updated) for Q1-25 with the CITI Economic Surprise Index fallen into negative territory- all beneficial for bond and defensive assets.

[1.7.25] - THE MACRO BRIEF: LIQUIDTY, CURVES AND USD - bit.ly/3DM7Z0k

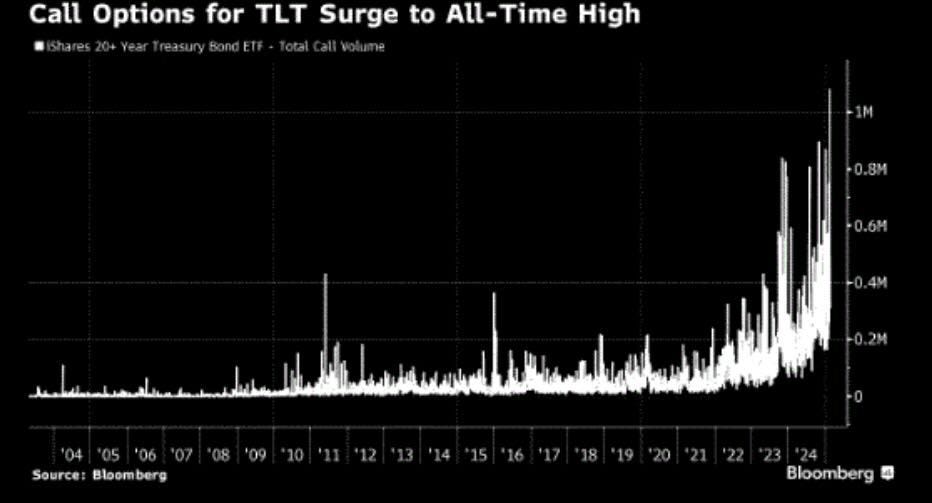

TLT call volume has surged to record levels with TLT short interest at record levels. Short squeeeeeeze incoming.

Here was our 17-to-1 portfolio insurance play on TLT that offered over 600 days of protection a little less than a year ago.

[5.22.24] - Recession-Proof Your Investments: Leveraging TLT Options for a 17-to-1 Payoff - shorturl.at/XkmQ4

Below, I'm going to get into two mining stocks worth accumulating - buy & hold - to take advantage of the next upswing in growth.