The Recession of Revisions Is Growing Suggests The Philly Fed, Idea Updates

The Philadelphia Fed's CES indicates further negativity

During Wednesday's Federal Open Market Committee (FOMC), Fed Chair Jerome Powell was asked about the labor market strength, and he stated that it was likely that the payroll report was overstating the strength of the labor market (the constant downward revisions should be telling enough).

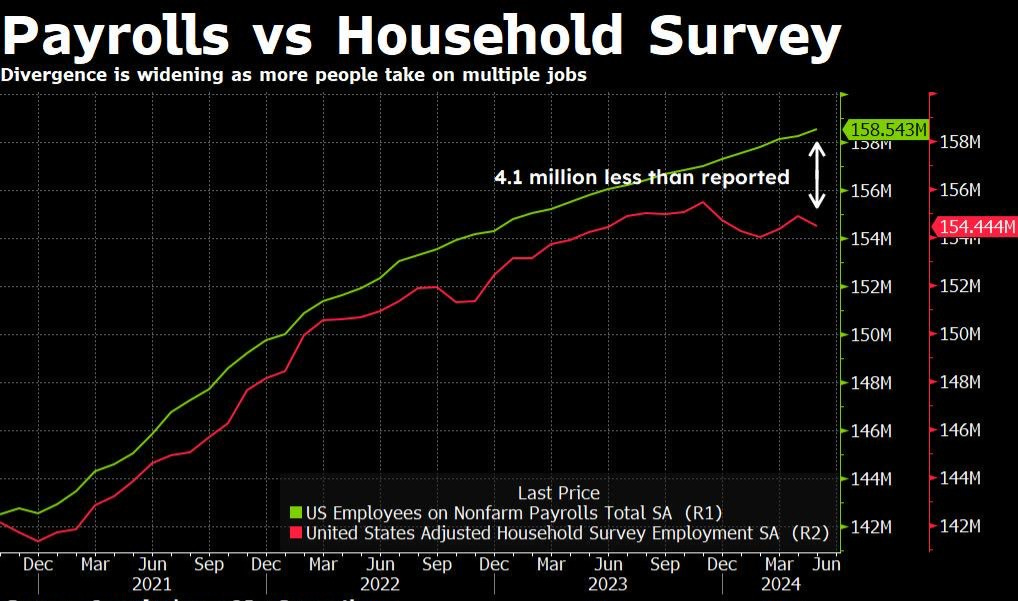

The gap between the Bureau of Labor Statistics (BLS) nonfarm payrolls report and the household survey stands at just over 4.1 million - staggering if true. the 1y z-score of the difference between the two data sets is 3 in favor of the BLS nonfarm payrolls. It's unlikely that the gap between the two is that severe but an ongoing gap, nonetheless.

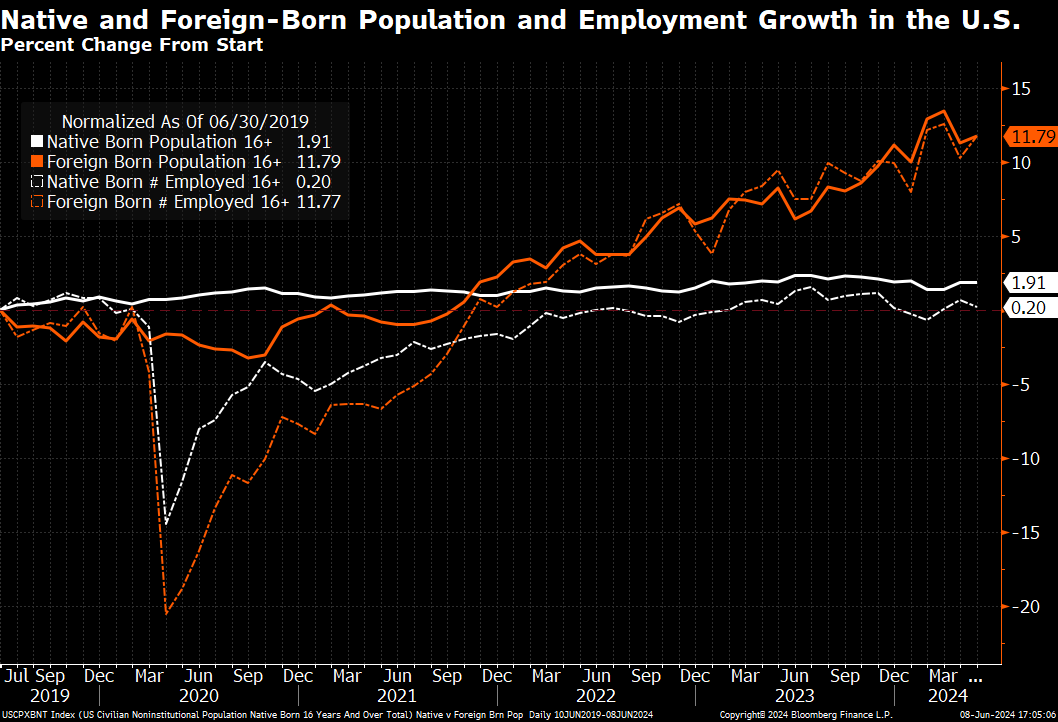

In what seems like a jab to the Biden Administration, Powell also remarked that the strength within the labor market is the result of (the lack of) immigration policy.

As you can see from the chart above, the foreign-born employed versus the native born is also staggering, and the two populations wildly begain to diverge in late 2021. New subscribers can check out my '“Inflation Eats Consumer” note where I warned that the labor market was not as strong as stated in Q2-22.

Not only was I correct back in 2022, if you look at supplemental employment data, you'll see that JOLTS job openings peaked. Nonsupervisory average weekly wages and Indeed's wage tracker peaked, too. Small business nonfarm payrolls peaked, and the listed goes on. The economy turned in 2022.

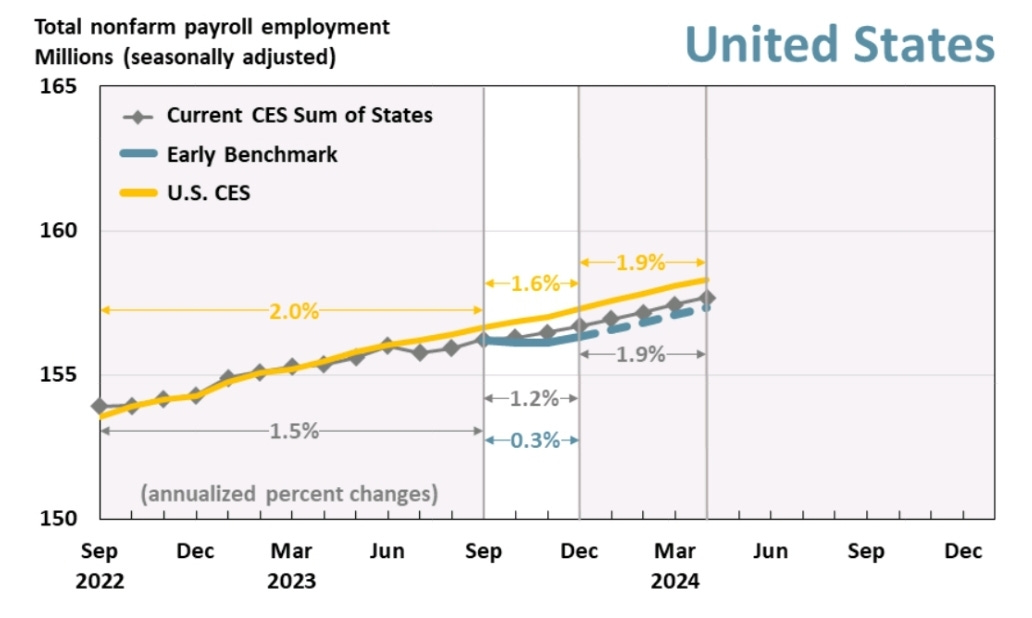

Now, the Philadelphia Fed's Early Benchmark compares employment data with the BLS’ Current Employment Statistics (CES) report came out for Q4-23, and it's looking like there will be more downward revisions to the nonfarm payrolls data.

The CES compares its data to estimates provided by the BLS. The differential between the two is night and day. The BLS states payrolls grew 1.6% in Q4-24 while the Philly Fed's early benchmark says payroll growth is more like .3%

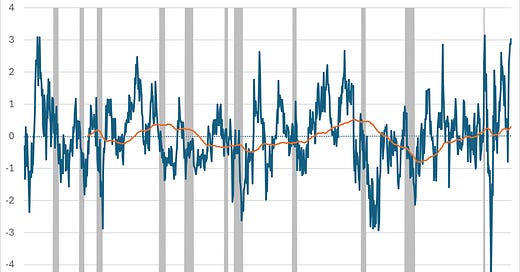

Labor market data, more broadly, indicates that the U.S. labor marker turned in 2022 while the Philly Fed's data shows that it quickly eroded throughout 2023.

Most notably was California which has a statistically significant negative payroll growth in Q4-23. New Jersey also saw a drastic divergence between the 2.3% growth (CES) compared to the .2% decline, according to the early benchmark.

With the labor market continuing to weaken, I'll be going over my long/short ETF idea heading into Q3-24.