There are a lot of misconceptions around the sanctions surrounding Russia.

Yes, sanctions will hinder Russia's economic growth and ability to transact, but in-and-of-itself is not the end of the world. It will, though, likely accelerate the rate of probability for a global recession.

Fist, the “kicking out” of theThe Society for Worldwide Interbank Financial Telecommunication (SWIFT) is a pain in the ass, but people think this booting Russia out of the global dollar system.

SWIFT is merely an interbank communication system. There are no reserves or settlement involved in SWIFT. Russian banks will struggle with engaging and settling of transactions but will use workarounds.

The Clearing House Interbank Payments System (CHIPS) is much smaller than SWIFT. CHIPS accounts are directly under the Federal Reserve to settle dollar transactions.

According to the U.S. Treasury, U.S. banks have 30-days to close out all Russian-linked accounts. This is more of a hit than the SWIFT exclusion as it effectively prevents dollar settlement.

Additionally, Russian banks could contact suitable banks directly outside the SWIFT system either directly or use an intermediary bank, and Russia has been unwinding down their dollar exposure since 2014.

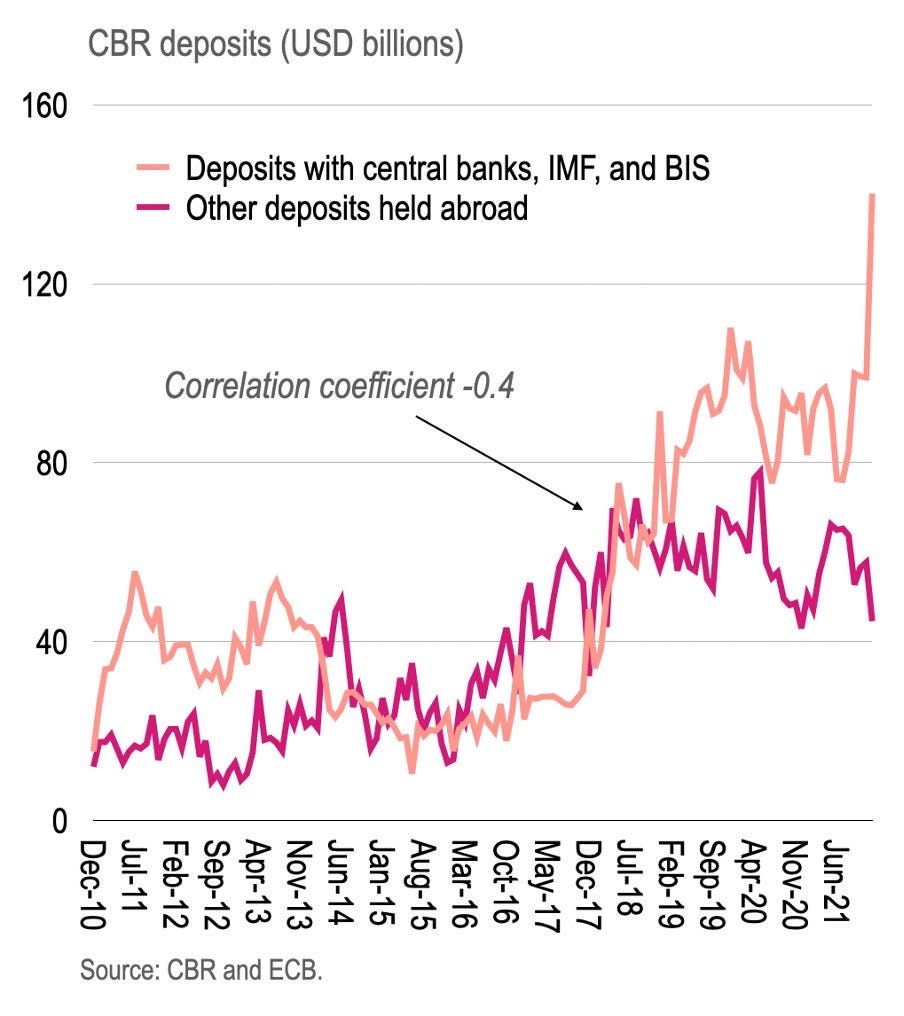

What’s interesting is that Russia may have been seeing that these sanctions were a possibility and move deposits into foreign central banks and other currency like euros, yen, yuan and gold (this will play a huge roll in liquidity moving forward).

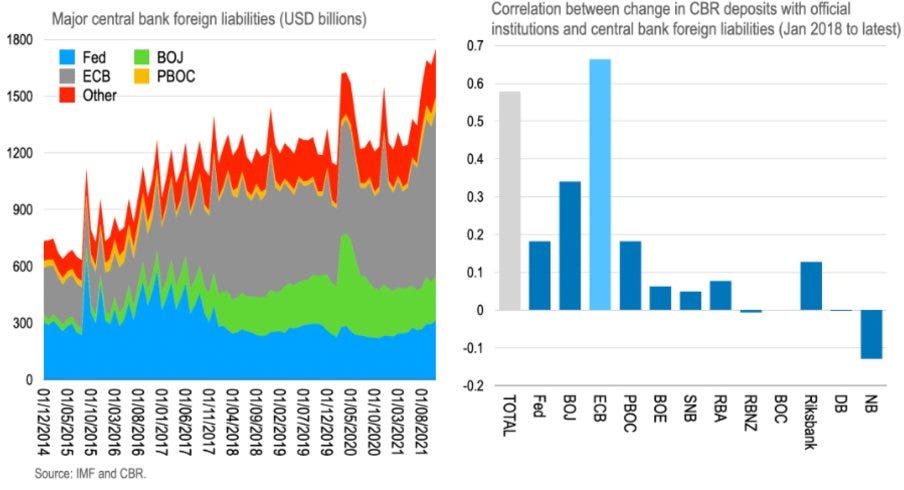

The chart above was provided by Chris Marsh, who previously worked for the IMF. What is shown is the correlation of withdrawn deposits from the Central Bank of Russia with the addition of deposits at other central banks.

It’s uncertain if this is true, but it looks as though Russia has been stock piling reserves at the European Central Bank (ECB) and the Bundesbank (Germany's Central Bank).

Moreover, we’re likely seeing hot money flowing into bitcoin and other cryptocurrency as Russians try to work around sanctions and a falling ruble.

We’ve already seen U.S.-based Coinbase, followed by other exchanges, that they will not block Russians from using their services.

This further increasing the risk of regulations by the U.S. government and others may follow.

Overall, the sanctions against Russia will hurt but not bad enough. As mentioned in “The Macro Brief: Inflation Eats The Consumer As Saving Rate Continues To Drop,” the U.S. and Europe are facing 30% YoY increasing in energy prices. Food prices continue to move higher, too.

The sanctions carve out exceptions for energy, agriculture and derivative trades. Energy products and agriculture account for 68% of Russia's export base.

And, the finer print on the Treasury sanctions suggest that energy as a sector is off-limits as long as it works through a non-U.S. intermediary, which is I love Russian oil and gas equities, especially at these prices.

The Macro Book: BUY When There's Blood In The Streets Pt. 1

Russia has the Europeans by the short and curries. Findlan depends on Russia for up to 94% of it’s natural gas; Bulgaria 77%; Germany 49%; Italy 46% and so on.

Energy and ag will be key work around for global sanctions against Russia.