The Macro Brief: Gold Loiters Near $1,980 as U.S. 2y Tightens Most On Record

Where Macro Meet Markets

Gold has been loitering near $1,980, and the inflation narrative has been keen in driving prices higher. With headline consumer prices surging at the fastest rate since the 1970s, it makes for a good case.

My bearish case on gold, near-term, often gets misconstrued. I’m not suggested gold is dead. I’m suggesting that the real yield and growth environment that’s shaping up is not conducive for strong prices.

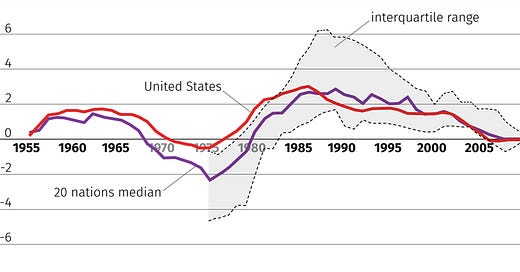

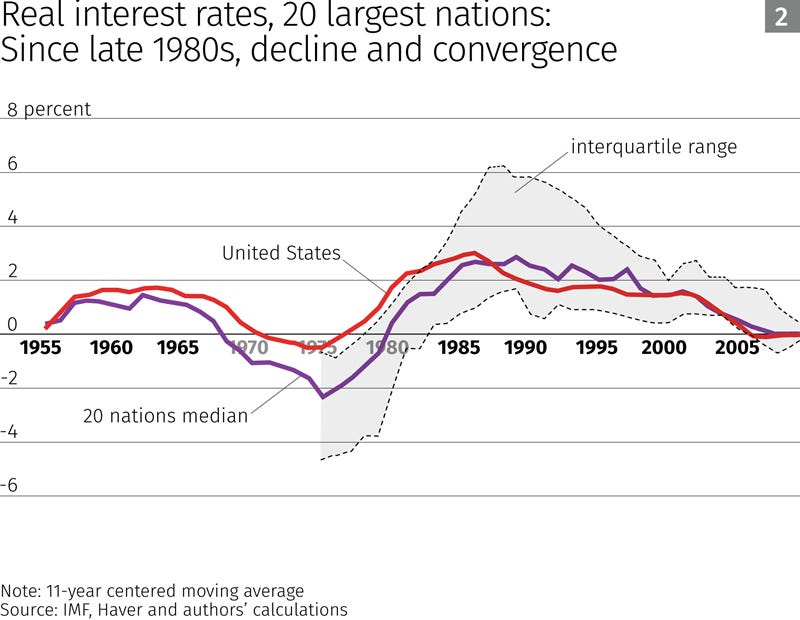

If we look a global and domestic real yields on a historical basis, we can understand the reaso gold exploded from $150 per troy once to over $600, especially from global investors.

Inflation expectations (not CPI) is a factor in gold prices, don’t get me wrong. However, real yields - and the rate of change - is in the driver’s seat.

Because gold is yield-less, it offers a better opportunity cost than a negative yielding asset. Although, the rate of change, especially in an accelerating environment, matters because it is simply less attractive.

Notice, though, that in 1981, real yield both globally and domestically went from negative to positive, and the U.S. went into a double-dip recession in 1981 and 1982.

Gold fell 58% over the same period. Bonds may pick up gold's slack.

The Macro Strategist is running a limited time offer of 50% off your Pro subscription. You’ll gain access to all paid material, exclusive charts and commentary found on @macrostratpro while learning how to navigate the financial and macro landscape like a pro!