The Macro Brief: Defensive Sectors Outperforming Cylcials Ahead of PPI/CPI

Where Markets Meet Macro

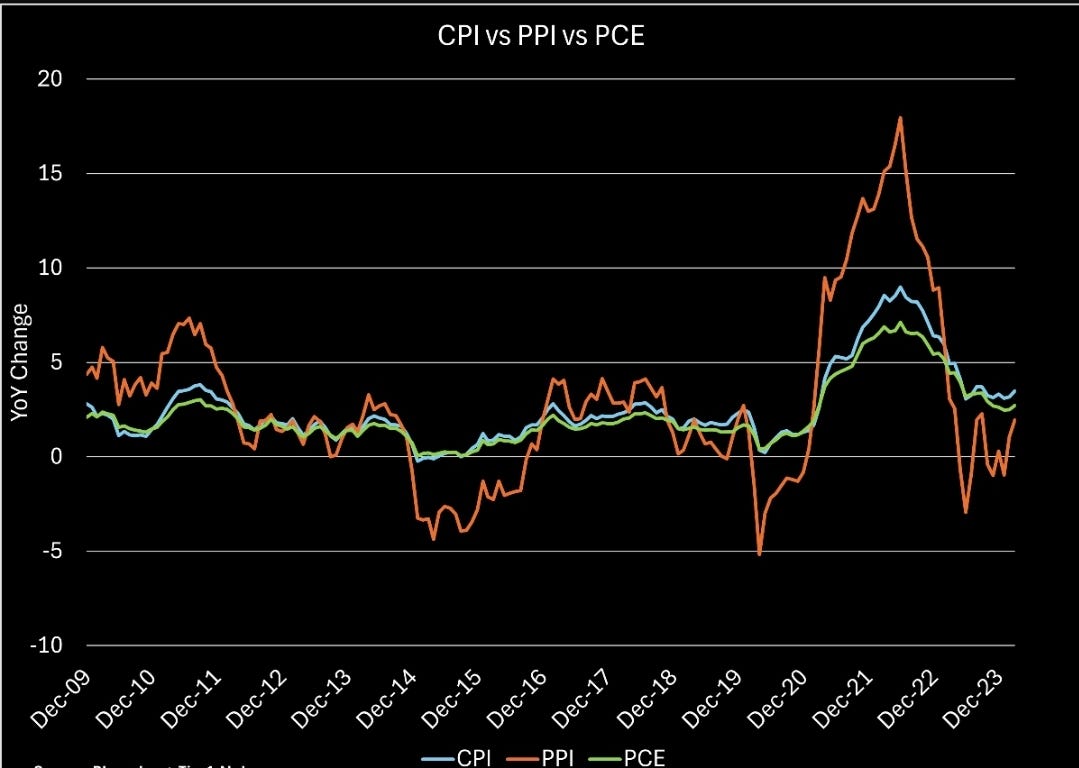

All eyes are focused on today's producer price index (PPI), but more specifically the consumer price index (CPI) on Wednesday.

The concensus for PPI is .2% MoM while CPI is .4% (3.4% YoY) and core CPI .3% MoM (3.6% YoY). We'll likely see PPI come in line before seeing declines in Q3-24 as lagging effects of downward pressure on commodity prices take hold.

(edit: PPI came out just before publishing. Hot! .5% MoM v. .2% expectations).

Consumer prices will be more tricky consider just how lagging the data set it. We could see .4% MoM on headline and .2% on core CPI MoM.

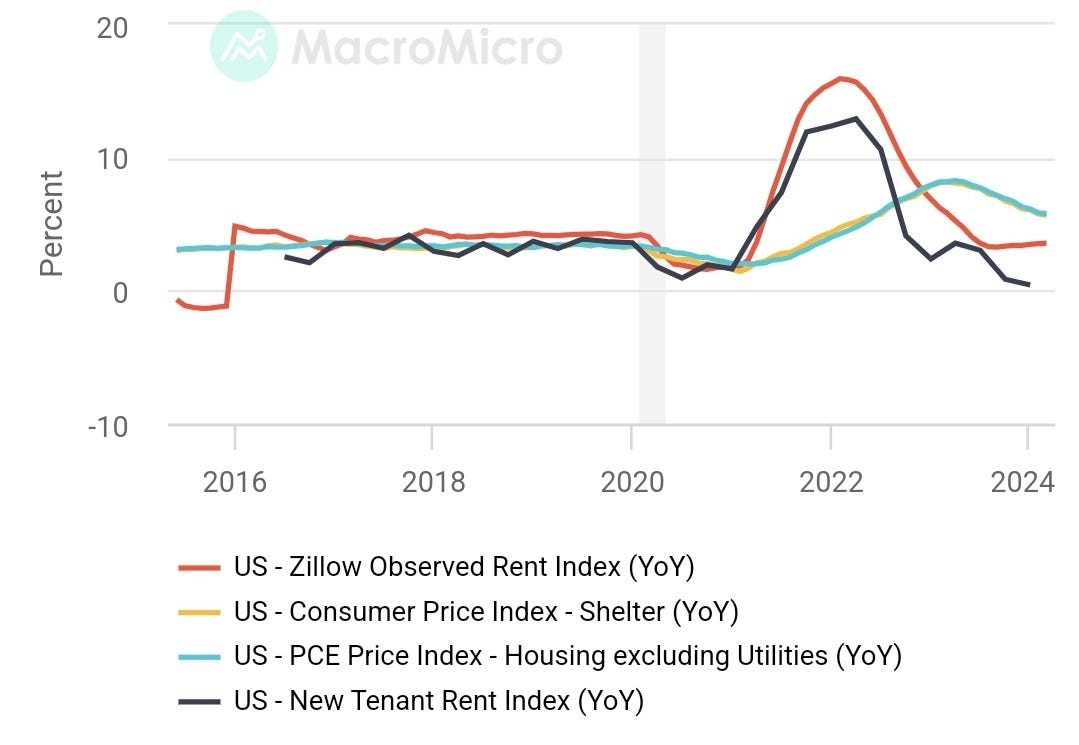

Owner's equivalent rent (OER) is over 30% of the core CPI print, and it lags as much as three years. It's simply not a reasonable measurement of what is occurring in the rental sector. New Tennant Rent Index has nearly flat-lined. Zillow's observed rent index also shows rental prices YoY are dramatically lower over the last two years.

As we head into “important” inflation-esque data, it is quite interesting that defensive sectors (utilities, consumer staples and healthcare) are now outperforming cyclical sectors; and with recent momentum in defensive sectors, they're not outperforming on a YTD basis.

Defensives in green; cyclicals in blue.

The move in defensives took place the Tuesday leading into the previous FOMC. Instintuallly, given how dovish markets took Preemptive Powell's decision to speed up the QT tamper, defensives are not what one expect to lead the rally.

In the rest of the note, I'll get into why I think defensives are leading cyclicals, what triggers to buy/sell them and whether bonds are an option.