The Macro Brief: Collateral Shortfall Will Create A "Buy At Any Cost" Moment

When Macro Meet Markets

Are we seeing the similar occurances as we did in 2018 and 2021? As market participants chase headlines, we could be ready for a “buy at any cost” for U.S. bills and bonds.

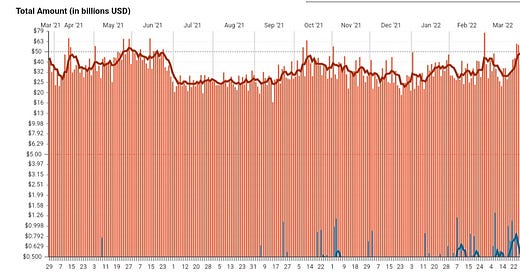

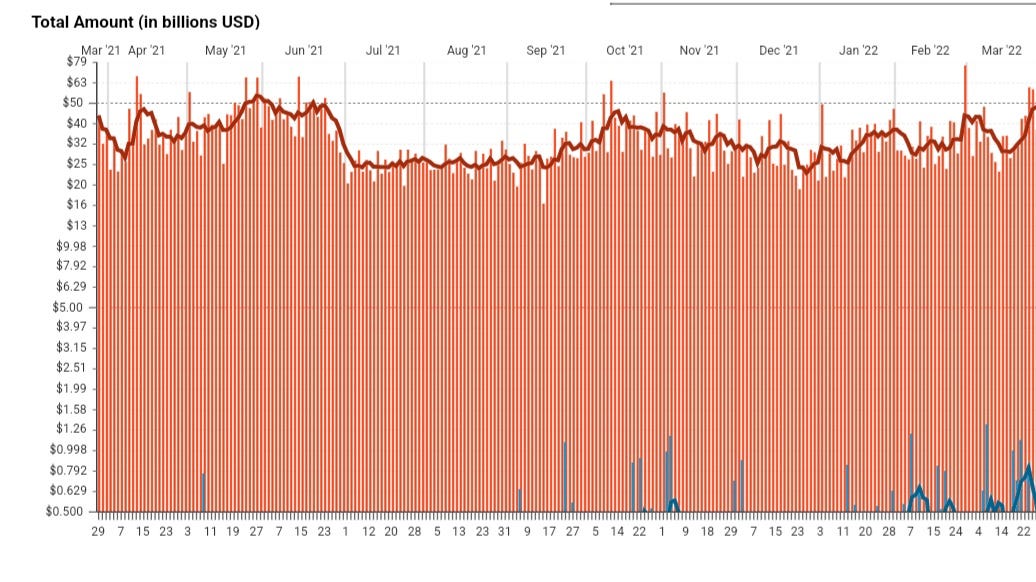

I’ve posted Treasury and Angency Fails (fail-to-deliver) charts by clearinghouse DTCC before.

A fail-to-deliver occurs when sellers fail to deliver, or buyers fail to receive, collateral in order to settle a trade.

Since the financial crisis, this tends to happen much more frequently now than prior, but prolonged fails tend to signal that the collateral market is starting to wobble; and we’ve now surpassed the one-year high 5-day average which is signaling stress.

Notice how back in 2021, U.S. bond yields bottomed on March 18th and the dollar begun rising May 4th as fails picked up dramatically. A flight to safety begun.