The Macro Brief: $148B In SPX Gamma Set to Expire As Markets Discount Rate Hikes

Where Macro Meet Markets

Today’s consumer price index (CPI) came in higher than expected at 9.1% YoY - a 40-year high. This was largely due to increases in gas and oil prices, collectively rising 7.5%

Core CPI, the Fed's perfered measure, fell .1% to 5.9%

Markets initially dropped on expectations of a ever-increasingly hawkish Fed as they’ve been willing to through the economy in the bin in order to lower inflation.

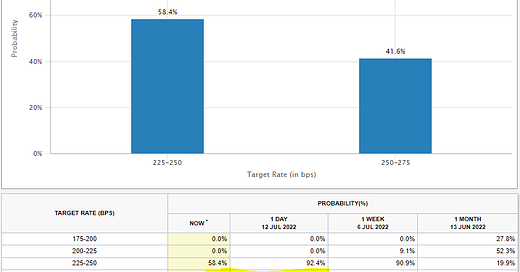

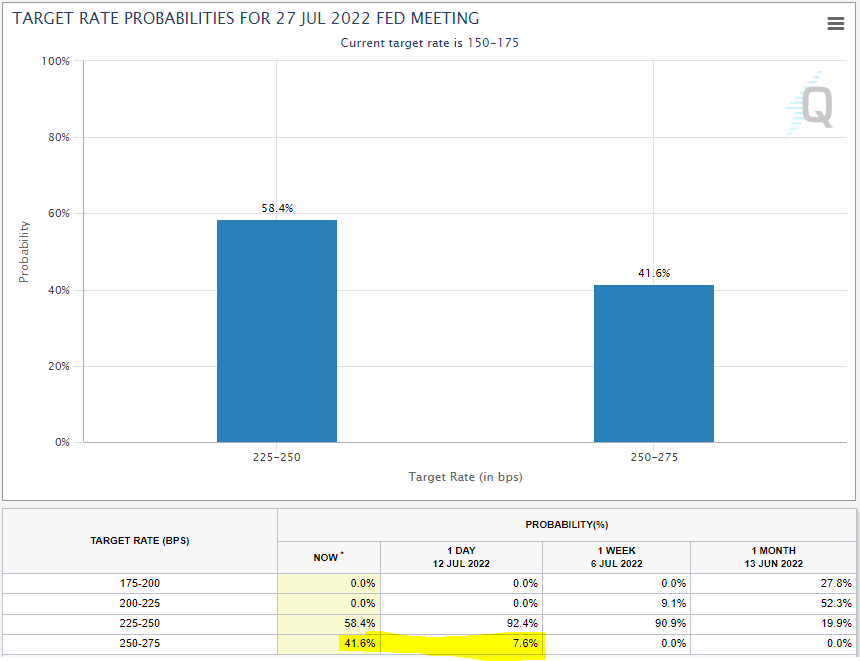

Nomura had come out expecting the Fed to hike a full percentage point during the Fed's next FOMC meeting.

Fed Chair Jay Powell has been on the record numerous times suggesting a 50-75 bps hike was on the table. This is aside from the quantitative tightening program where $47.5B in assets will mature and roll off per month until September where it increases to $90B.

It’s projected that every $100B off the Fed's balance sheet equates to an additional 25 bps hike vis-a-vis financial conditions tightening.

However, as rate hike expectations rise so do rate cut expectations as markets price in an end to tighter monetary policy.

This is helping alleviate some pressure in the bond market earlier today which also aided in a jump in gold and equities.

Read “The Macro Brief: 7 Volatility Charts As Market Remains Unhedged,” as I go over adherent risks market participants are opening themselves up to by remaining unhedged.

The following piece of this article is for The Macro Strategist Pro Subscribers, and I’ll go over the current SPX dealer gamma expiration Friday and what it could mean for equities near-term.

Subscribe to The Macro Strategist Pro, currently 25% OFF. Monthly Pro subscriptions are currently $15/mo for the rest of July only.