SPX & SPY Gamma Goes Negative As Ukraine Bombs Russia

Ukraine hits Russian with a long-rang strike as Biden Admin. rushes before Trump Inaugural.

Just a quick update on SPX and SPY gamma:

Days after the Biden Administration approved the use of U.S. made long-range misses within Russia, Ukraine did not hesitate. Futures are red as reported Ukrainian strike within Russia occured earlier this morning.

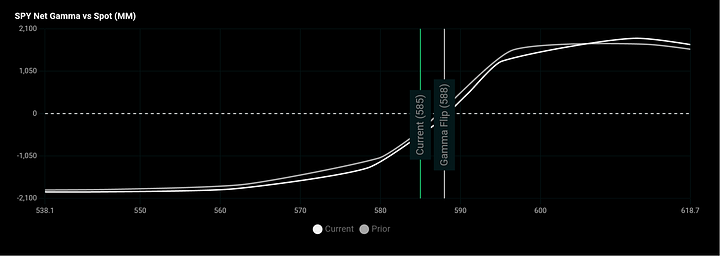

SPX gamma is negative (-$403m) after briefly turning positive on yesterday's bounce. SPY gamma is sliding deep into the negative (-$1b).

Negative gamma regimes are volatility expanding. Dealers sell dips and buying rips under this regime. Volatility is often high as they suck liquidity out of the market.

1m realized volatility (rV) is rising and above 3m rV. This is bearish and directly affect volatility-targeting funds. As volatility expands, vol funds will reduce exposure to equities, which has been a trend over the last week. Implied volatility (iV) rising over rV is also bearish.

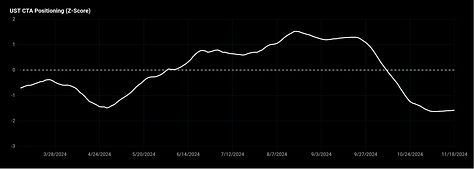

Commodity trading advisors (CTAs) are generally trend-following funds that buy and sell on a given trend at particular thresholds.

I have attached expected flows from both volatility control funds and CTAs on both up and down days.

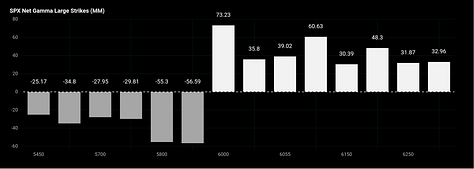

Large gamma strikes for SPX to the downside between 5700-5800 will act as a magnet on a gamma flip, while 580 on SPY is where large negative gamma strike sits.

Global equities trading trades: