Market Updates: Liquidity Stagnates As Yen Rallies, Fed To Cut In Dec.

THe Fed and BoJ comes into blurry focus as 2024 comes to an end.

Global liquidity continues to stagnate and will likely start to roll back over into year end as market participants anticipate the December Fed and Bank of Japan (policy) decisions.

If we take the liquidity picture at face value, the decline in liquidity is going to continue to remain a net-negative for global bonds opposed to the contrived narrative that there will be a 1970-esque resurgence in inflation.

With U.S. equities being a favorite, they will finish the year on top from global equities.

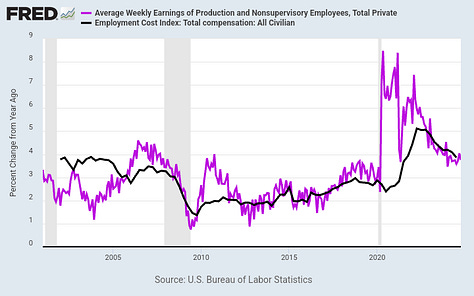

Yes, we can all agree that recent inflation metrics (pick your favorite) have moderately ticked higher after two years of steady declines.

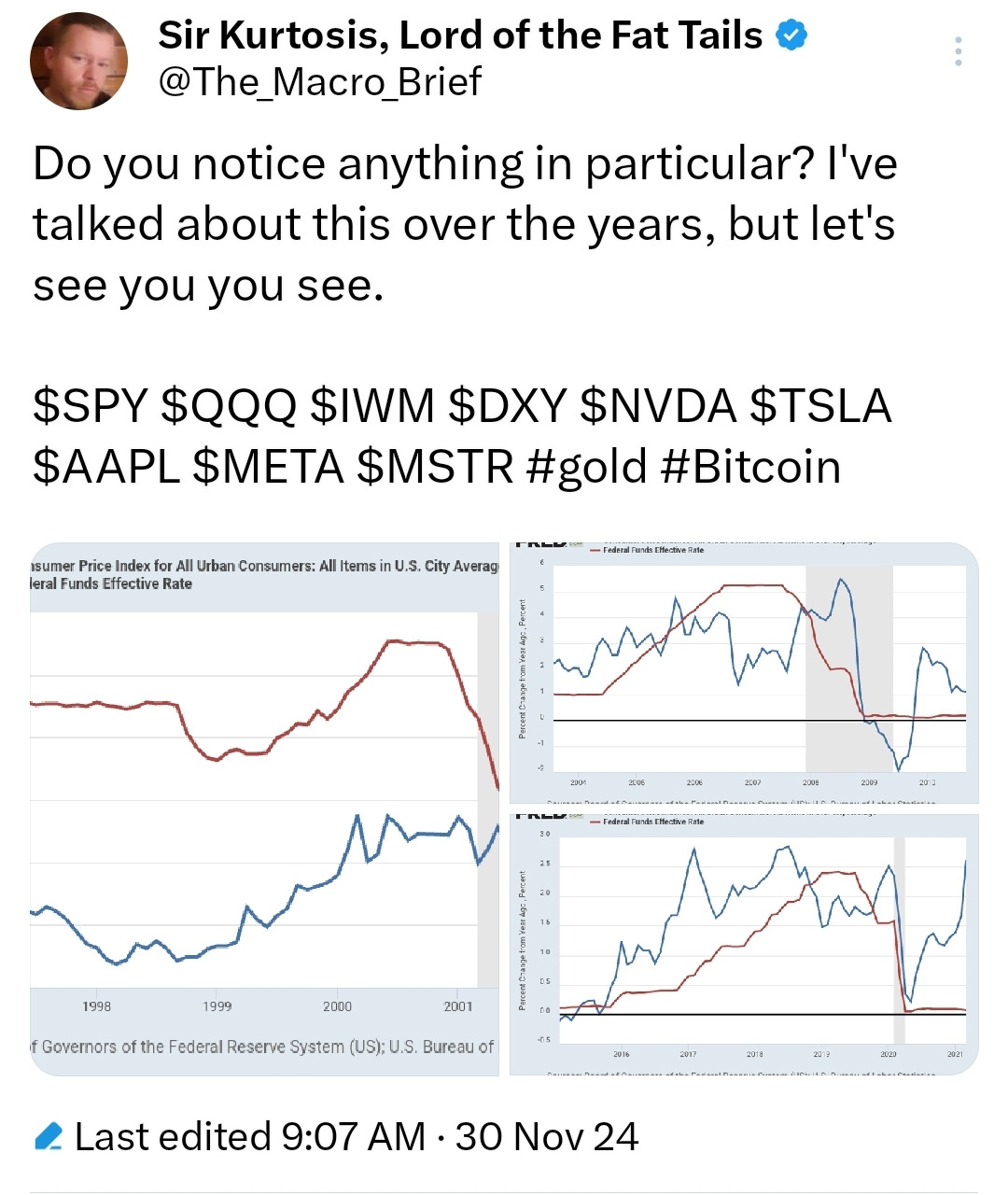

This is not something that is off my radar, but when taking it all in context with a declining macro backdrop and previous easing cycles, I posed this question:

Here are the charts of the Fed funds and consumer prices:

For those that may not see what I've been seeing is that consumer prices not only rise into recessions, but the late cycle push in prices occur AFTER the Fed begins the rate cutting cycle.

Furthermore, in order to get the dreaded 1970s inflation surge, we need both a credit-led consumption boom plus accelerating money velocity - both which we do not have.

Too be honest, it's not even fucking close.

The consumers ability to even spend is highly truncated, as well.

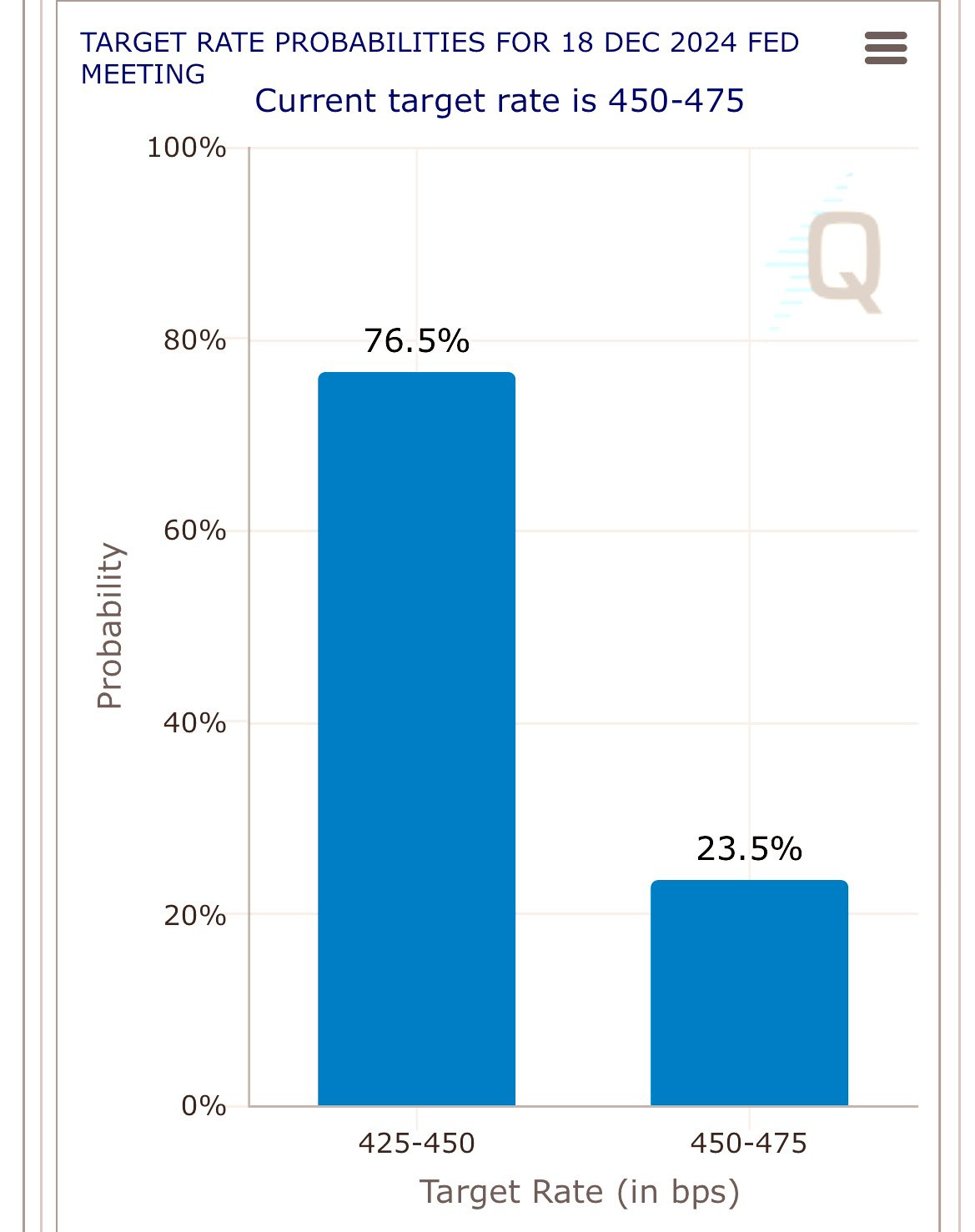

The market is pricing nearly an 80% chance of a 25 bps cut by Powell, and this was backed by the Fed board governor Christopher Waller.

With the Fed cutting, and the BoJ expected to hike, this is putting pressure on the yen thus the carry trade; and Japanese banks have been slowly unwinding since this summer.

Fed expectations over the next year (up = easing, down = tightening) is near May lows but slowly moving up which gave bonds a near-term reprieve, pricing in roughly 75 bps of cuts throughout 2025.

The dollar-yen is obviously a reflection of U.S. rates, and thus rate differentials which fuel the carry trade.

As I notified in June, the yen is moving weeks ahead of the BoJ meeting on the 18th (Fed on the 17th), which signals preemptive deleveraging within the carry trade.

Heading into Novemeber, the USDJPY was roughly 149 (where it is currently) and correctly expected a move higher. However, the pair did overshoot my 152 and neared 156 prior to turning around.

My base case still remains, and I expect the USDJPY to continue lower, but this is not a call that U.S. equities will sell off immediately or near-term.

Here are a few things to consider:

A lot going forward with depend less with whether the Fed and BoJ meet market expectations and more with policy guidance going forward.

Subdued and/or decelerating liquidty is net-bullish for the USD. This can blunt the yen advance from picking up too much speed.

U.S. equities, and, as of now to a lesser extent, bonds will see flows from carry trade unwinding. However, if the BoJ guides hawkish this could cause yen to repatriate back into Japan and exacerbate yen momentum higher.

Chinese has a role in this in regards to dollar strength. Keep an eye on the US/China 10y differentials. Strong differentials will favor dollar strength as Chinese yields move back to record lows following numerous ill-fated stimulus attempts (I hate to say I told you so).

… in another sign of desparation, it has now been approved that employees of Chinese technology firms can now take out loans to buy company stock (lmao).