Market Resilience Amid Volatility: BIS Quarterly Review Summary

A Mixed Outlook for Global Financial Markets

Market Resilience Amid Volatility: A Mixed Outlook for Global Financial Markets

The latest BIS Quarterly Review highlights a turbulent period from June to early September 2024, where markets faced substantial volatility due to shifting monetary policy expectations and macroeconomic uncertainties. Despite these bouts of turbulence, financial conditions remained broadly supportive, underscoring investor resilience.

Key Developments:

De-Risking Episodes and Equity Market Sensitivity

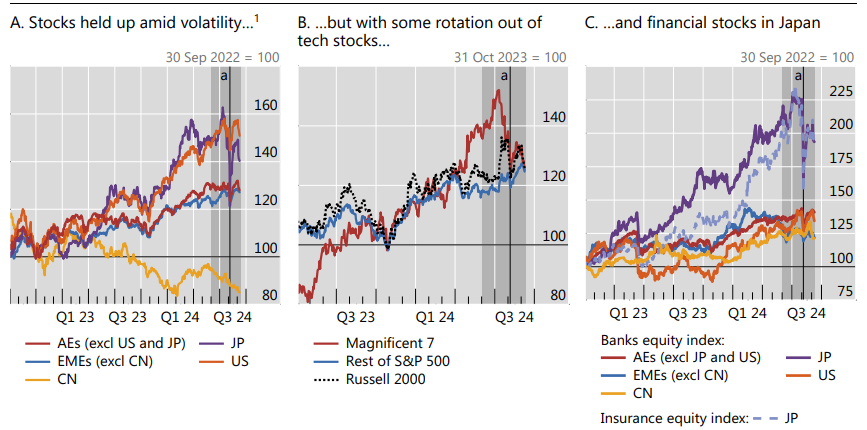

Market volatility surged in early August, driven by a correction in tech stocks and reactions to hawkish central bank policy signals. The sell-off was accelerated by disappointing U.S. labor market data, which spurred de-risking and carry trade unwinding.

However, markets rebounded quickly, suggesting strong investor sentiment and hopes for a soft landing.

Graph 3.A – Global equity markets fell but quickly rebounded. This chart shows the trajectory of equity markets across various regions, highlighting how they recovered losses within a few days.

Bond Markets Signal Easing Ahead

Expectations for monetary policy have shifted markedly towards an easier stance, as inflation approached target levels and growth concerns intensified. This was reflected in a synchronized decline in global bond yields, particularly at the short end, as markets began pricing in earlier and more aggressive rate cuts.

Graph 1.A – Short-term yields declined…

This chart illustrates the decline in short-term bond yields across major economies, supporting the narrative of changing monetary policy expectations.

Carry Trade Unwinding Adds to Volatility

The unwinding of carry trades amplified volatility in FX markets, with funding currencies like the yen experiencing sharp, if temporary, appreciation. Despite this, the impact on foreign exchange volatility was contained compared to equity market reactions. Emerging Market Economies (EMEs), though exposed to these shifts, demonstrated resilience with limited spillovers, partly supported by expectations of easier monetary policy in advanced economies.

Intraday VIX spike was extreme but short-lived…

This chart shows the spike in volatility during the August sell-off and how quickly it subsided, demonstrating the resilience of market sentiment.

Persistent Tech Sector Valuation Risks

The correction in tech stocks, particularly among the "Magnificent 7," highlighted vulnerabilities due to high valuations amid a potential growth slowdown. While their valuations have come down from mid-year peaks, the market's optimistic earnings expectations may face increasing risks if economic conditions deteriorate.

Graph B1.A – Rising share of tech market cap in the S&P 500 index

This chart helps visualize the concentration of tech sector valuations, drawing parallels with past market cycles.

EMEs Navigate Macro Headwinds with Mixed Results

EMEs withstood market spillovers but continue to face headwinds from weaker growth outlooks and political uncertainties. While some currencies depreciated during the August turbulence, others, such as those in Asia, saw appreciation as carry trade positions were unwound. Notably, Chinese financial markets remained subdued, reflecting domestic economic challenges, with government bond yields hitting record lows.

Graph 7.A – Higher-yield EME currencies went through bouts of depreciation…This chart shows the impact of carry trade unwinding on emerging market currencies, particularly in Latin America.

Conclusion:

The September 2024 BIS Quarterly Review underscores the market's ongoing vulnerability to shifts in monetary policy expectations and macroeconomic data. While financial conditions remain favorable, the rapid oscillations in sentiment highlight the importance of cautious positioning and preparedness for sudden shifts. The interplay between de-risking episodes and investor optimism will likely shape the outlook as markets continue to navigate the balance between growth concerns and policy adjustments.