As inflation pressures mount globally, central banks are grappling with the delicate task of tightening policy without stifling growth. For investors, navigating this landscape means reassessing safe-haven assets, with gold once again emerging as a focal point. Let’s explore the dynamics of inflation and interest rates across economies, and how these trends are influencing the role of gold in portfolios.

Last day to join at 50% off!

US Inflation Pressures and the Fed’s Balancing Act

After a decade of muted inflation, the US economy finds itself wrestling with rising price levels, prompting the Federal Reserve to recalibrate its stance. Real and nominal yields provide insight into market expectations of inflation and growth.

US 10y Real and Nominal Rates

This chart reveals the widening gap between nominal and real yields over recent years. As nominal rates hover above 4%, the inflation-adjusted yield remains below, signaling that inflation expectations are still deeply embedded in the market. The divergence serves as a litmus test for the Fed's ability to tame inflation without tipping the economy into recession.

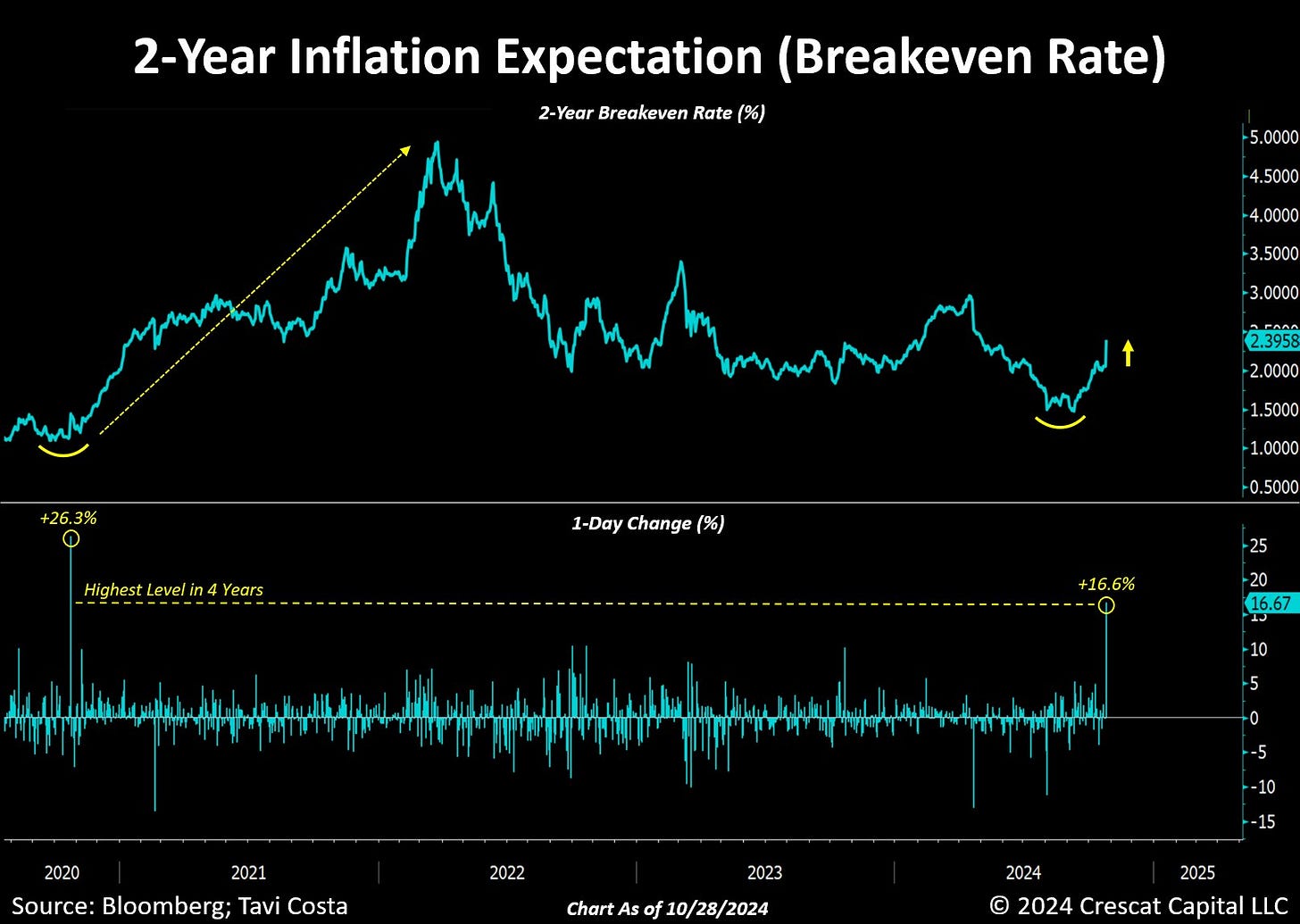

2-Year Inflation Expectation (Breakeven Rate)

The breakeven rate tells a similar story. Currently, at its highest level in four years, the 2-year breakeven rate reflects a market recalibrating for persistent inflation. This uptick raises a pivotal question: are we heading toward entrenched inflation, or is the market overestimating the inflationary cycle?

The European Inflation Surge - Germany in Focus

Across the Atlantic, the inflationary narrative is equally compelling. Germany’s inflation metrics offer a lens into the broader European experience, with energy prices and supply chain issues adding fuel to the fire.

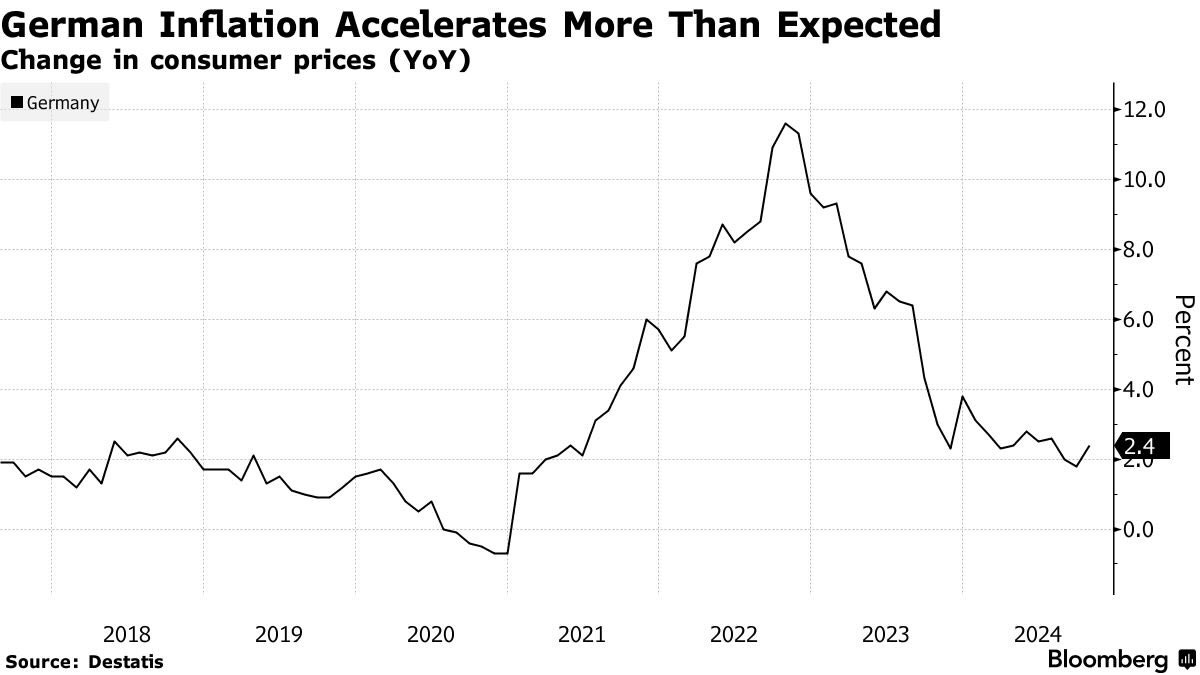

German Inflation Accelerates More Than Expected

This chart underscores Germany's inflationary path, which peaked sharply before recent moderation. With inflation now at 2.4% YoY, the data highlight the European Central Bank's dilemma: curbing inflation without curtailing the fragile growth in Europe’s largest economy. The chart serves as a reminder that the inflation challenge is not confined to the US.

A Cross-Country Comparison of Growth and Inflation

The impact of inflation is felt differently across economies, with some nations experiencing slower growth alongside high inflation, while others see more robust economic expansion.

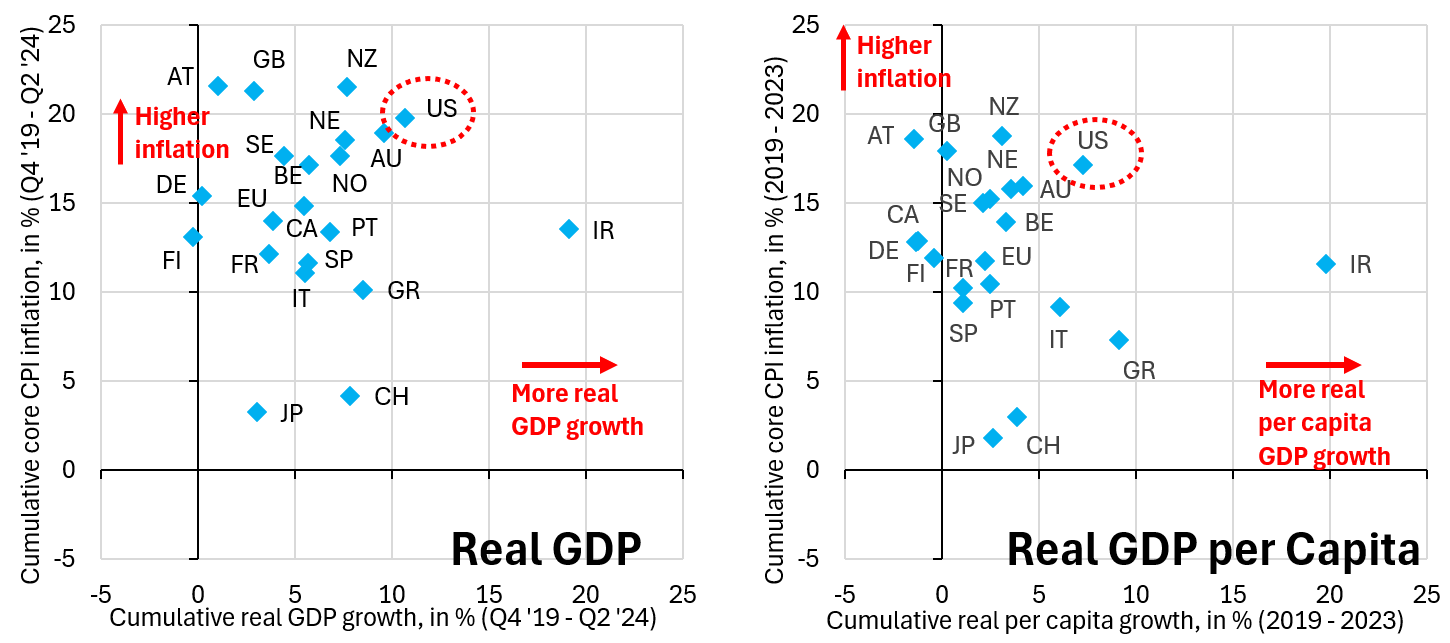

Real GDP vs. Inflation Across Economies

This cross-country comparison visually maps GDP growth against cumulative inflation, positioning the US at an interesting intersection. Higher inflation has not deterred growth as strongly in the US compared to peers, which could reflect a resilient consumer base. The scatter plot reveals divergent inflation-growth dynamics, spotlighting countries like Japan, where inflation remains subdued despite moderate growth.

Gold - Rediscovering Its Role in a High-Inflation World

As investors recalibrate portfolios in response to persistent inflation, gold has reemerged as a potential hedge. History suggests that gold’s allure often intensifies during periods of economic instability.

Gold Inflation-Adjusted Price (Historical)

This chart takes us through gold’s inflation-adjusted journey, from its peak during the inflationary 1970s to today’s high. The recent rally suggests a renewed interest among investors seeking refuge from potential dollar debasement and negative real rates. With inflation still above target, the case for gold remains compelling.

10-Year UST Yield with Fed Rate Cut

This chart, marking the Fed's recent rate cut, is a reminder that accommodative policy in terms lower fed funds does not automatically translate into lower yields in bond markets.

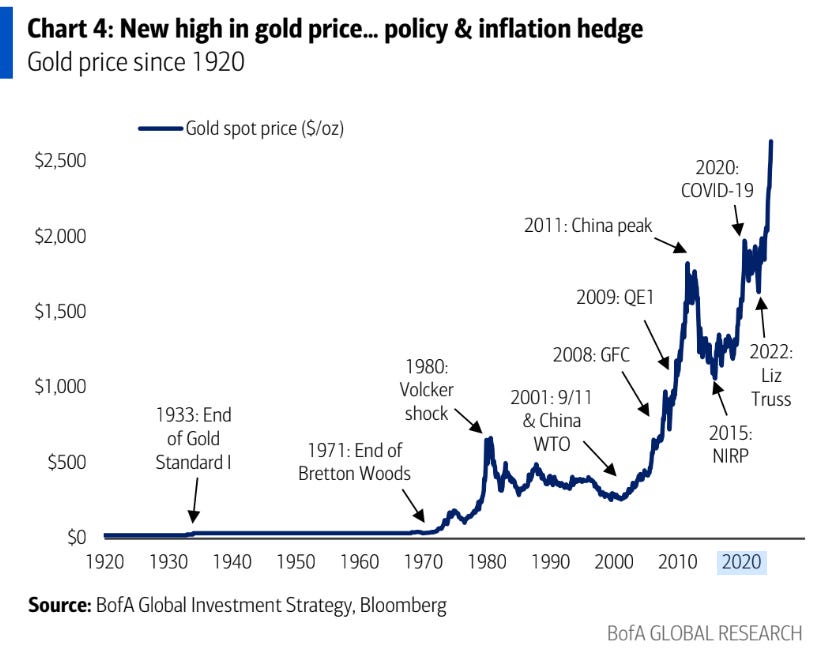

Long-Term Gold Price Since 1920

Providing a century-long perspective, this chart illustrates gold’s enduring role as a store of value. Major economic events from the Volcker Shock to the Global Financial Crisis are highlighted, showing gold’s resilience and consistent value preservation in times of economic stress. Today’s levels suggest that gold’s role in portfolios remains as relevant as ever.