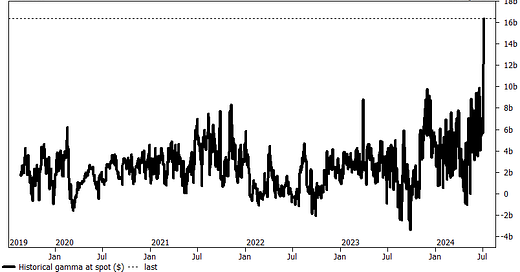

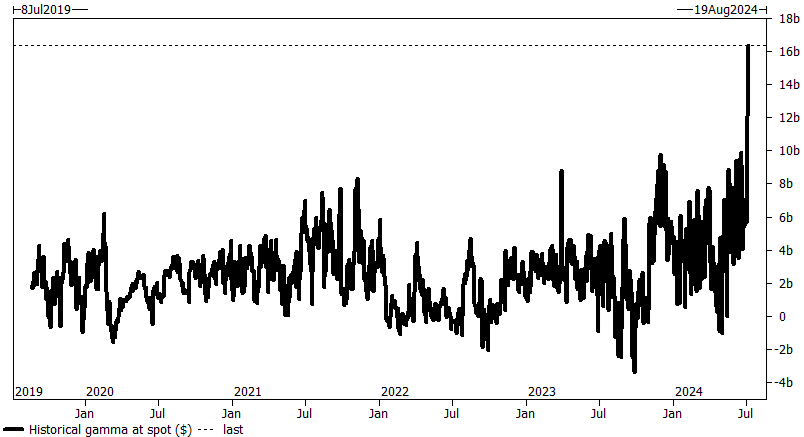

Options Gamma Hits Historical Levels as Realized Vol Drops to Five Year Lows

CTAs, Vol control funds near max allocation as volatility is suppressed

According to Goldman Sachs, long gamma is at an extreme level. They estimate that $16B in /ES contracts will need to trade against the current trend for every 100 bps movement. When gamma is positive, dealers are long gamma and will need to hedge into the current trend using futures, SPY or similar correlated instruments.

And, because volatility is so compressed, expect a lulling grind higher without an erogenous shock.

I talk about needing a level of cognitive dissidence is yesterday's note.

Behind the paywall, I'll talk about where we're at with SPX gamma, fund equity exposure and the importance of realized vol at current levels.