Has Liquidity Turned To Support The Chinese Narrative?

China promises huge stimulus as traders buy what's beaten down

Chinese equities have gone from the most underperming to year-to-date winners, and all it took was central bank narratives.

That's all it ever takes.

The primary issue, though, is the data has to eventually walk the walk after traders talk the talk.

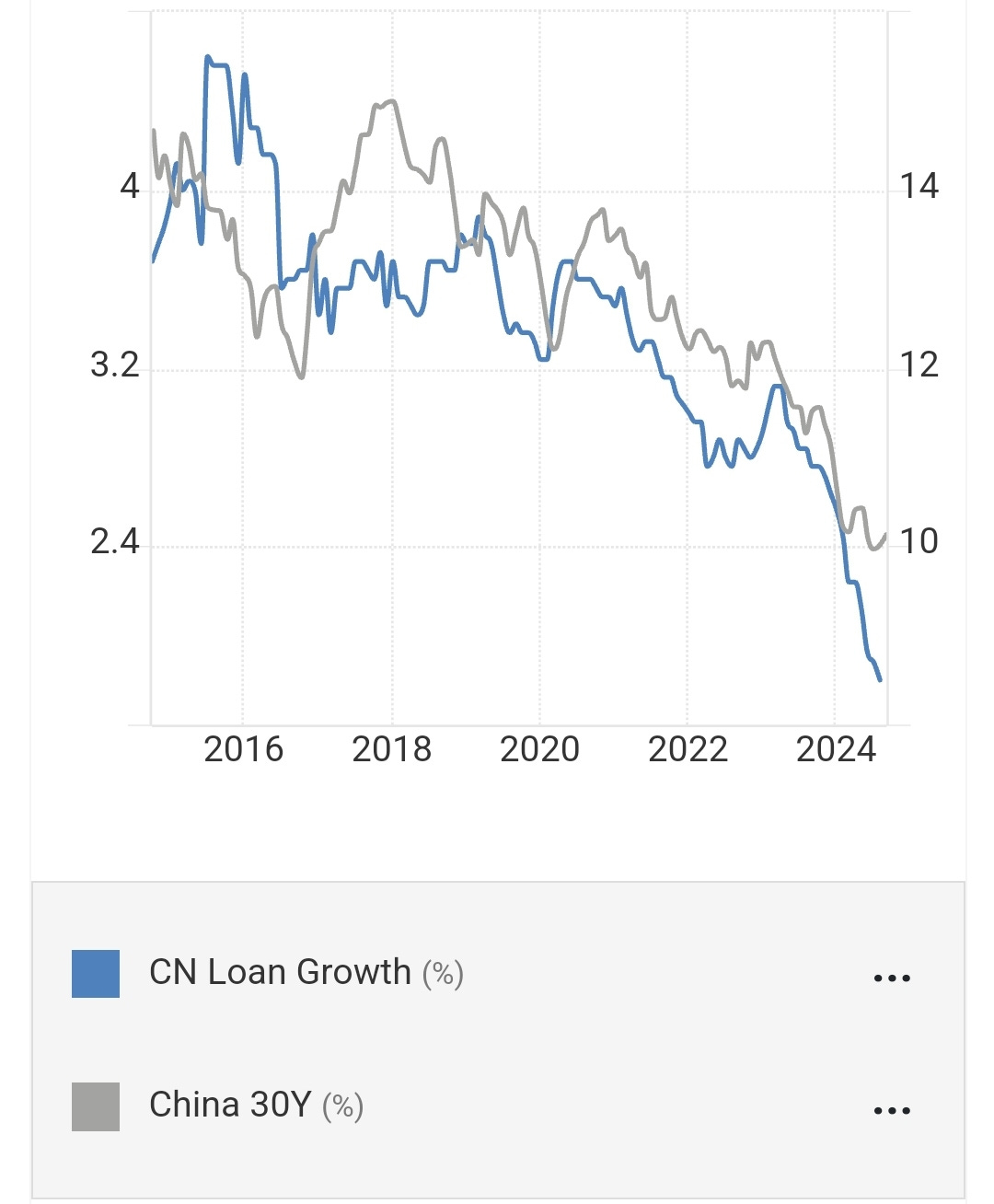

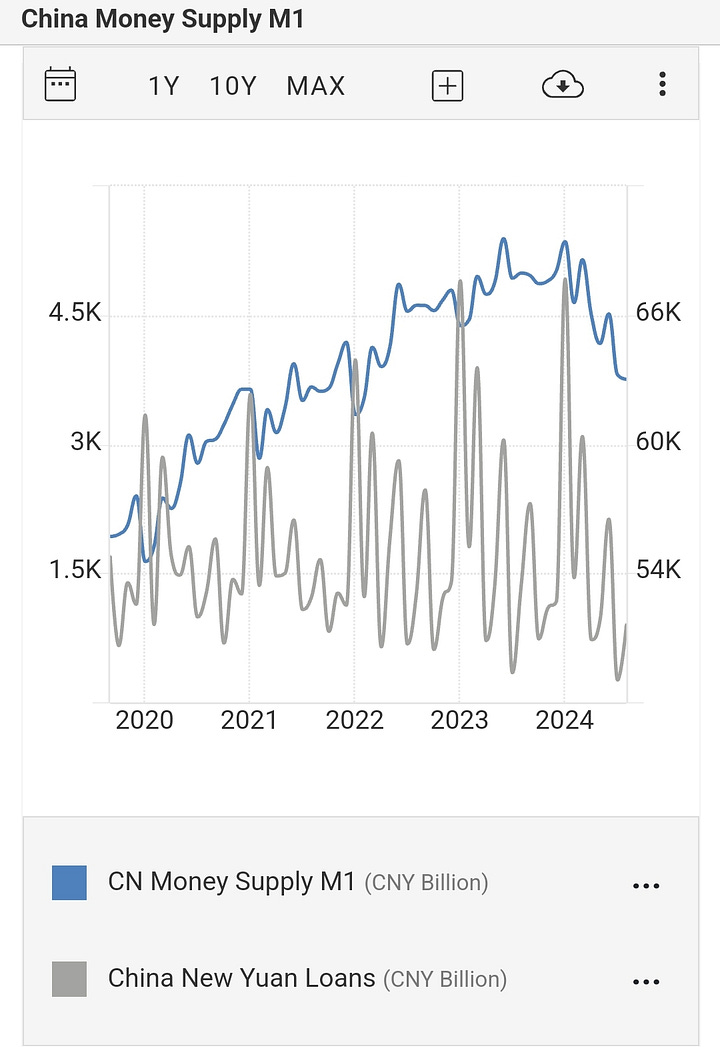

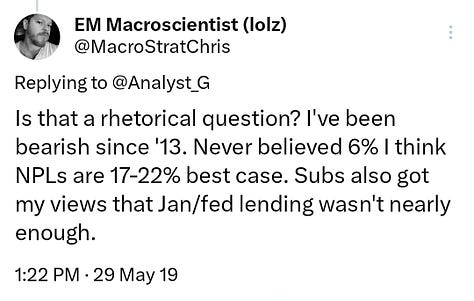

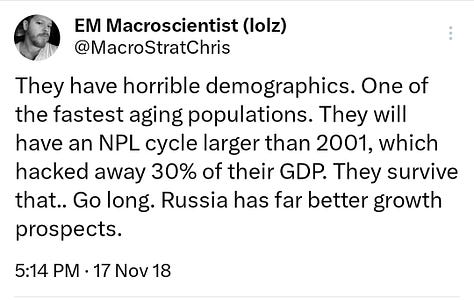

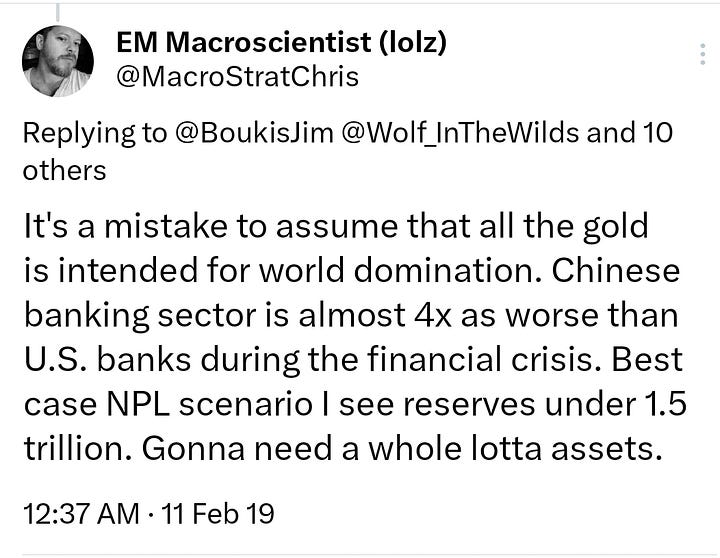

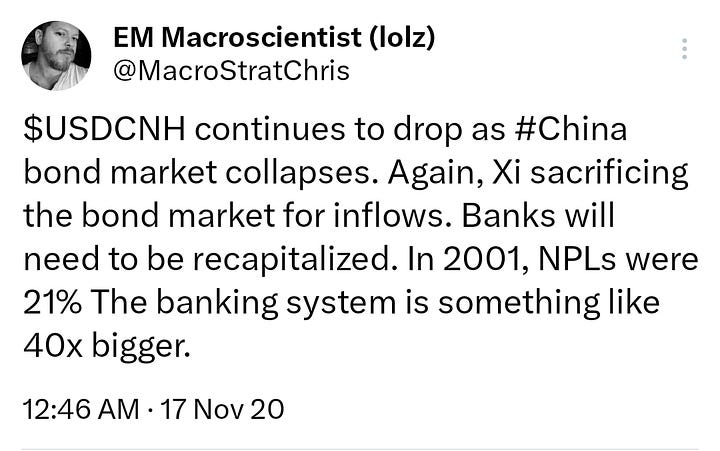

There is virtually no lending as China is finally faced with the largest non-performing loan (NPL) cycle since 2000.

The Bloomberg China Credit Impulse (newloans/GDP) are nearing 2018 lows which, coincidentally, was the last time China struggled obtaining dollars.

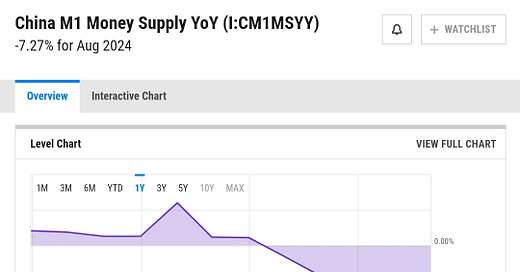

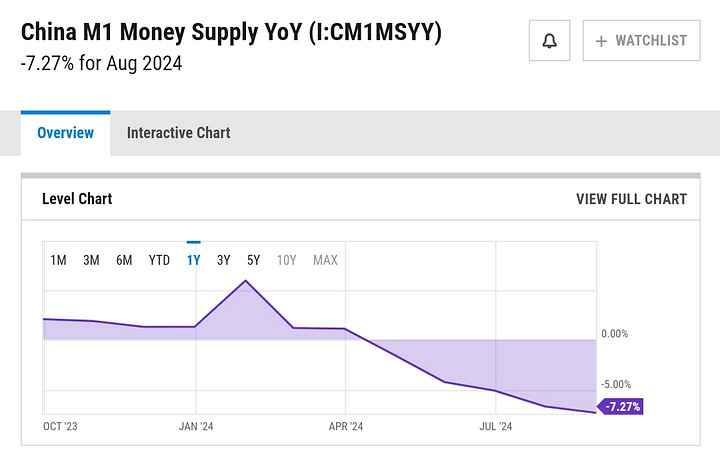

The whole stimulus ploy is intended to shake the Chinese flight to safety (i.e. buying Chinese bonds).

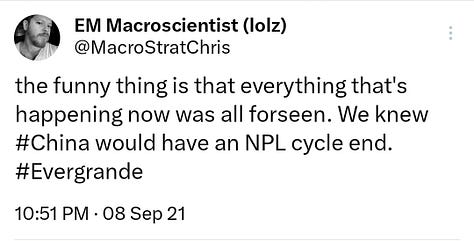

Macro Brief readers already know that I was sounding the alarm on Chinese yields back in 2021. The flight into bonds have been years into the making, and it looks back for the CCP.

It's all about optics.

Xi and the Politburo is trying to paint a picture and risk is back on, and it is momentarily.

Both global liquidity (money supply proxy) and the US liquidity proxy are turning lower. This week's volatility in U.S. markets could be attributed to the lonshoreman strike, but, as this AM's trading ranges shown, US equities are moving from strong bulltrend to weak bull; and the VIX is solidifying into a strong bull trend.

The move into Chinese equities have been a relative strength trade, and a solid one if you caught it.

I'll be sure to fade all the goodies (FXI, KWEB and select commodities) when they reach the trade range tops. No need to FOMO on either side of the trade.

It took a 30% short squeeze in Chinese equities for a marginal blip up in yields.

Updated trading range dashboards for commodities and select Chinese equities sent out to paid subscribers on US close.