Gold Briefly Falls 3% As Hedges Unwind Following The U.S. Election

Seemingly a Donald Trump win pumps stocks, but is there more?

Gold briefly rebounded in yesterday's session after falling three percent on the reelection of President Donald Trump. The huge weekly candle comes after printing a “graveyard” doji candle, which some chart technicians use as a signal of a trend reveral.

The chart above shows where similar price formations occured and resulted in a downward trend for gold prices.

The 7- and 30-day rate of change has been dramatically shifting lower prior to the post-election decline in gold prices.

We also say the same thing in silver prices. Although, silver has been moving lower for about a week, signaling weak hands or potentially, as I've been leaning towards, a subsiding move in bullish speculation.

Both gold and silver moves have pushed price movements into negative zscore territory which provides some support for pullbacks in downward momentum.

Small caps, tech and all the risk assets goodies ripped following the confirmation of another Trump term, but market participants came into Novemeber 4 hedged with the SPX put/call ratio near the highest on record.

I do not believe it would have been any difference, initially, with a Kamala Harris win. However, we hedge uncertainty, and I think the biggest risk was whether or not either party would refuse to concede the election results. The massive electoral and popular vote win for Trump eased uncertainty for market participants.

We can also look at the SDEX (skew) and TDEX (tail hedges), and we seen buying of out-of-the-money (OTM) puts, and as they are unwound it forces equity prices higher.

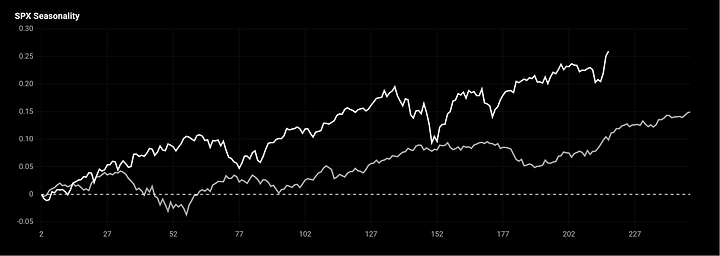

This is not to suggest that the equity rally won't continue. For one, when considering seasonality, this is prime time to buy.

Here, I wrote how mechanical flows would take over irrespective of poor macro data. Coming into this week. That is beginning to fade, however, with CTAs and Vol control funds reducing equity exposure. VIX cash is crushed in mid-15s but 1m rV is rising. This could become an issue.

Below, I'll go over gold potential opportunities or risks and what Powell may be hinting at, following the 25 bp cut.