Federal Reserve Beige Book: Economic Conditions Show Slow Growth and Mixed Trends

Economic Activity, Labour Markets & Prices and Inflation

The latest Beige Book report, released by the Federal Reserve in September 2024, paints a picture of an economy growing at a slower pace, with significant regional variation. While some Federal Reserve districts reported modest improvements, a growing number highlighted flat or declining activity, particularly in the manufacturing and real estate sectors. Here's a closer look at the key takeaways:

National Overview

Overall Economic Activity

Economic growth was tepid, with three districts reporting slight improvements, while nine saw flat or declining activity. Consumer spending, which had been stable in prior periods, ticked downward, and manufacturing continued to contract in several districts. Rising interest rates and inflationary pressures weighed on economic momentum across sectors.Labor Markets

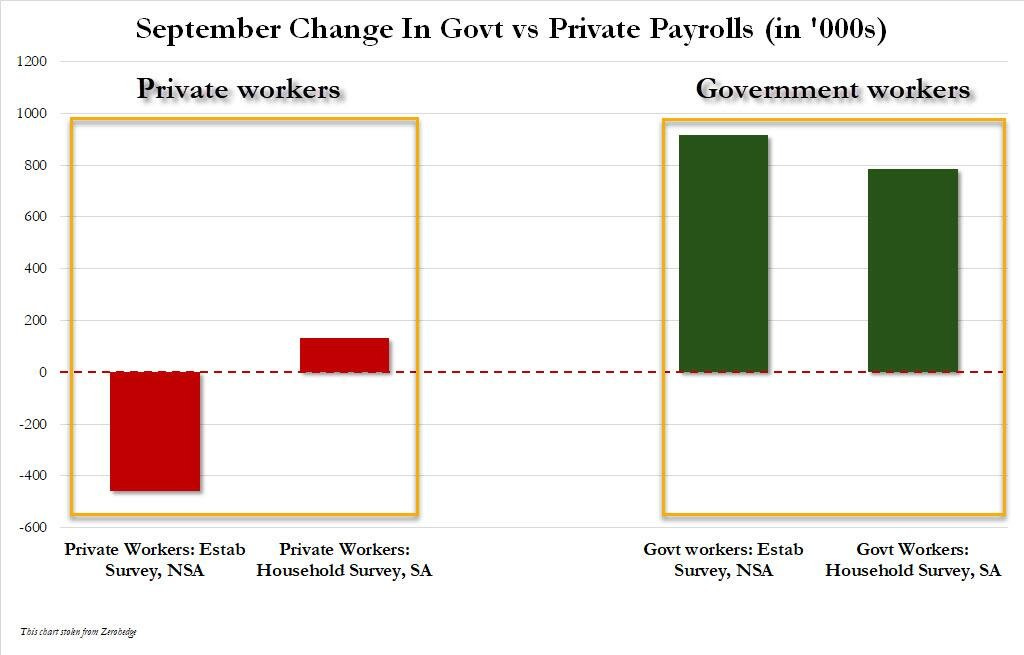

Employment levels were mostly steady, although several districts reported businesses reducing shifts or relying on attrition rather than layoffs to manage headcounts. Wage growth was modest, reflecting easing demand for workers. However, shortages of skilled labor, particularly in trade sectors, continued to push wages higher in specific industries.Headline numbers are likely to be misleading as they are driven by surveys which are currently showing low response rates.

The US actually lost a half-million private sector jobs, however government contribution to growth has been significant to say the least.

Prices and Inflation

Inflationary pressures remained present but showed signs of moderating. Prices grew modestly, and input costs generally eased, though certain districts still reported rising costs for freight and insurance. Many districts expect pricing pressures to stabilize or even decrease in the coming months.

Core inflation rate US YoY %

Key Regional Trends

Manufacturing Weakness

Most districts reported a decline in manufacturing activity, particularly in sectors sensitive to consumer demand and construction. This contraction was part of an ongoing trend as businesses navigate weaker demand and higher input costs.United States Exports By Category

Real Estate and Construction

Real estate activity was mixed, with residential construction and home sales slowing in most districts due to high mortgage rates. Commercial real estate saw a slight uptick in retail leasing but continued to struggle with office space demand. Some regions noted an increase in demand for industrial space, while others reported a downturn.United States Existing Home Sales MoM

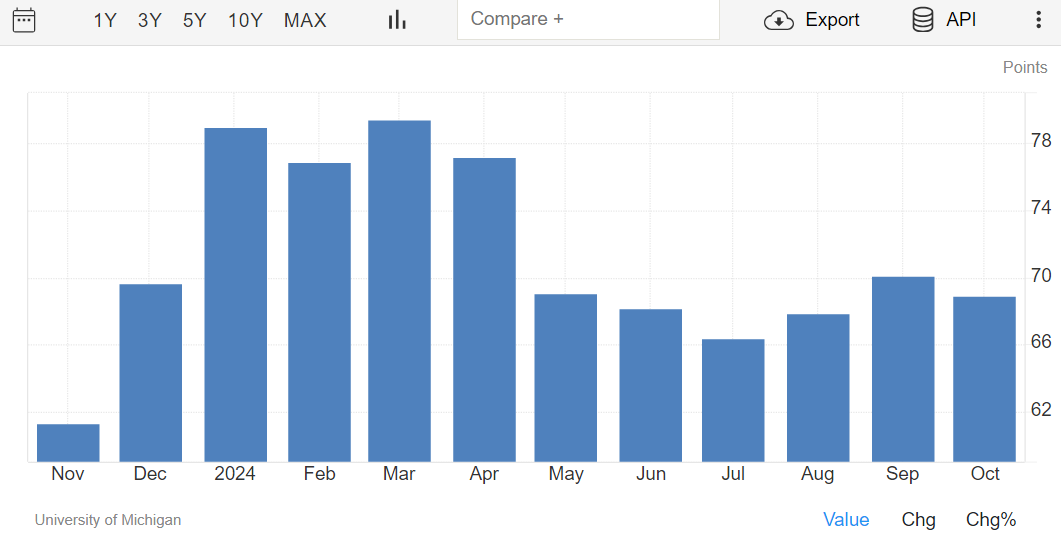

Consumer Spending and Sentiment

Consumer spending showed weakness, with many districts noting a shift in behavior toward value-focused purchases. Retailers reported softer sales, especially for big-ticket items like vehicles, due to high interest rates. On the positive side, tourism remained stable in several districts, supporting the service sector.US Consumer confidence

District Highlights

New York: Economic activity remained flat, with the labor market cooling and manufacturing showing little change. However, housing markets remained solid, with slight price increases in home sales.

Chicago: Economic activity rose slightly, driven by business and employment spending. However, manufacturing was flat, and the construction sector edged down. The outlook for farm income in 2024 worsened.

Atlanta: Economic activity declined slightly, with weaker consumer spending and housing demand. Transportation and manufacturing sectors also contracted.

Investment Implications

Monitor Inflationary Pressures: The moderation in price increases signals potential stabilization, but sectoral variations in cost pressures remain a concern. Investors should stay cautious about industries sensitive to input costs.

Selective Exposure to Real Estate: The downturn in residential real estate offers caution, but the slight uptick in retail and industrial spaces may present opportunities for strategic investments.

Labor Market Watch: As wage growth moderates and labor shortages persist in specific skilled sectors, industries reliant on highly skilled labor may face continued upward pressure on labor costs.

Conclusion

The September 2024 Beige Book reflects a mixed economic environment with signs of slowing growth in several key sectors, particularly manufacturing and real estate. While inflationary pressures are easing, high interest rates and cautious consumer behavior continue to shape the economic landscape. The next few months will likely see a continuation of these trends, with regional variability playing a critical role in economic performance.