As we approach the end of 2024, market participants are keenly observing seasonal patterns across asset classes. From precious metals to cryptocurrencies and equities, December has historically offered significant clues about year-end rallies and setups for the new year. Here’s what the data reveals and how traders can position themselves effectively.

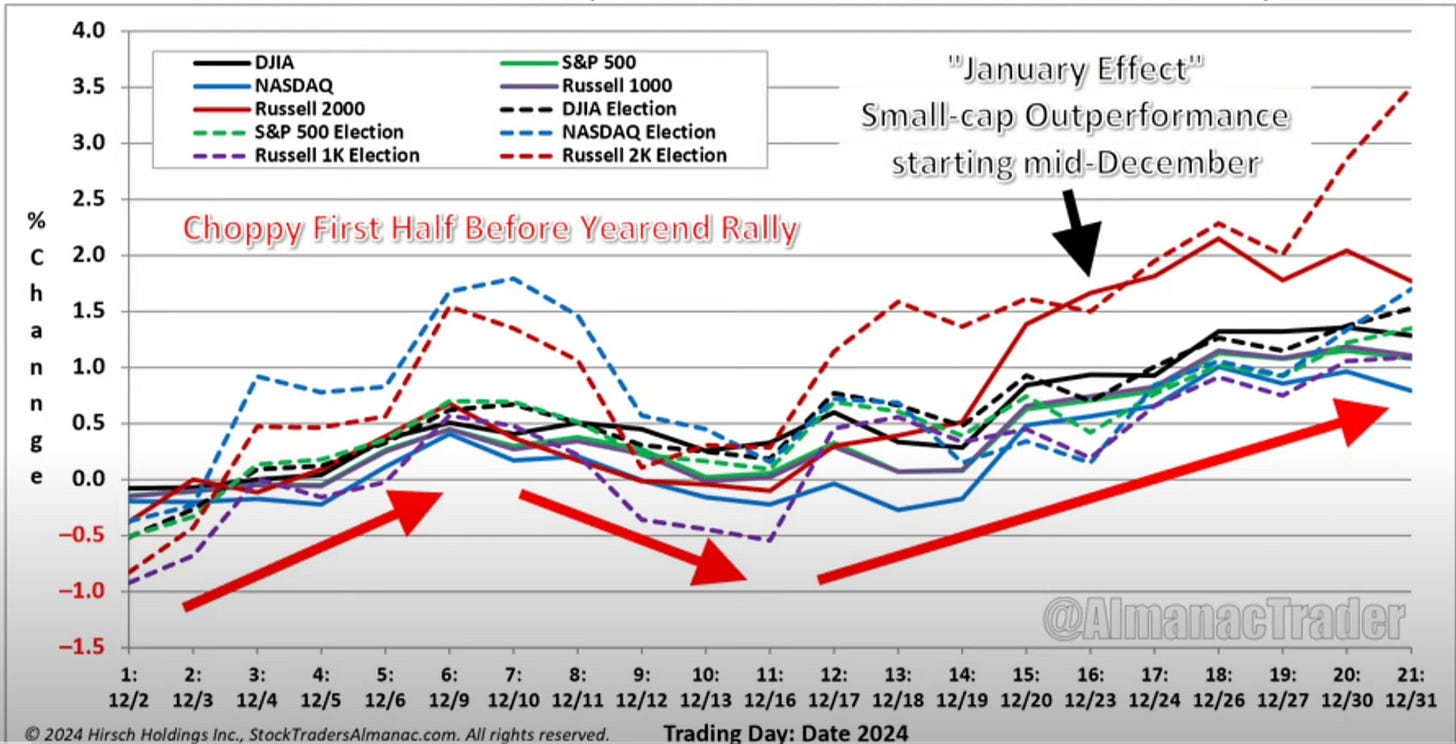

The "January Effect" Kicks Off Early for Equities

December isn’t just a month for holidays—it’s also the precursor to the famed “January Effect.” Small caps, in particular, exhibit notable outperformance starting mid-December. This phenomenon aligns with year-end tax-loss harvesting and reinvestment cycles.

Highlighted trends:

A choppy early December often gives way to a rally across major indices, with the Russell 2000 leading the charge.

Election-year dynamics (as shown) amplify these patterns, creating opportunities in small-cap-focused ETFs or futures.

Takeaway: Tactical exposure to small-cap indices could prove rewarding. Pairing this with a long gold or oil play may create a diversified seasonal portfolio.

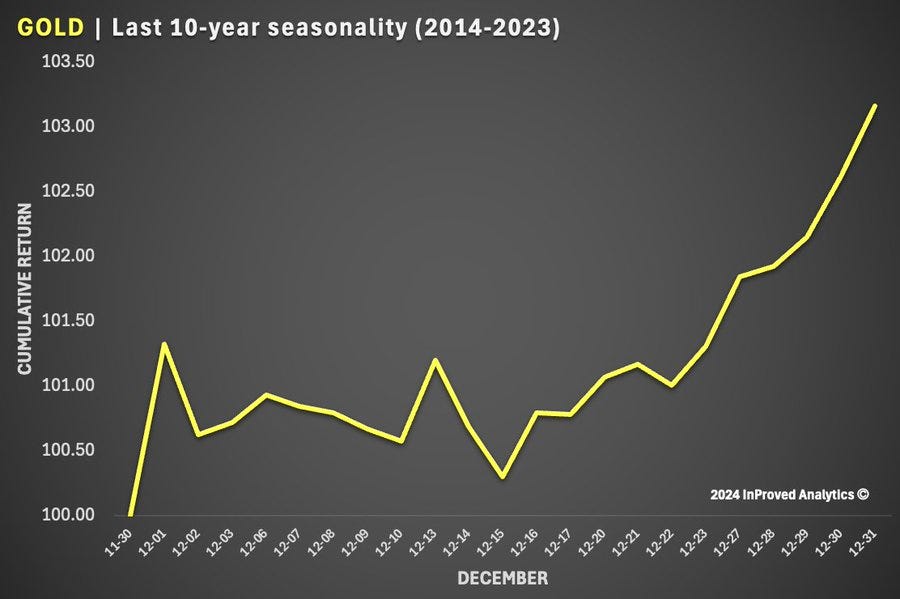

The Golden December: A 10-Year Seasonality Pattern

Gold, often regarded as the quintessential safe-haven asset, displays an intriguing December rally. Over the past decade, cumulative returns in the final month of the year highlight a clear upward trajectory.

Key observations:

The first week of December often sees a mild dip, attributed to tax-loss selling or profit-taking.

Post mid-December, the rally gains steam, typically fueled by portfolio rebalancing and renewed safe-haven demand.

Actionable Insight: Traders eyeing gold ETFs like GLD or futures could consider initiating long positions around mid-December. Pairing this with a risk-off hedge on broader equity indices may enhance risk-adjusted returns.

Bitcoin's Persistent Bullish Bias

Bitcoin, the digital gold has recently taken all the headlines after hitting $100,000, interestingly it mirrors a seasonal trend akin to its physical counterpart. The data over the last decade suggests December remains bullish, with momentum often spilling into January.

Why?

Institutional inflows dominate year-end trading, as funds rebalance crypto allocations.

Retail investors often jump back in post-holiday discussions around Bitcoin's long-term narrative.

Strategy Call: A breakout above key resistance levels could signal another December surge. Options traders might look at long calls for asymmetric exposure.

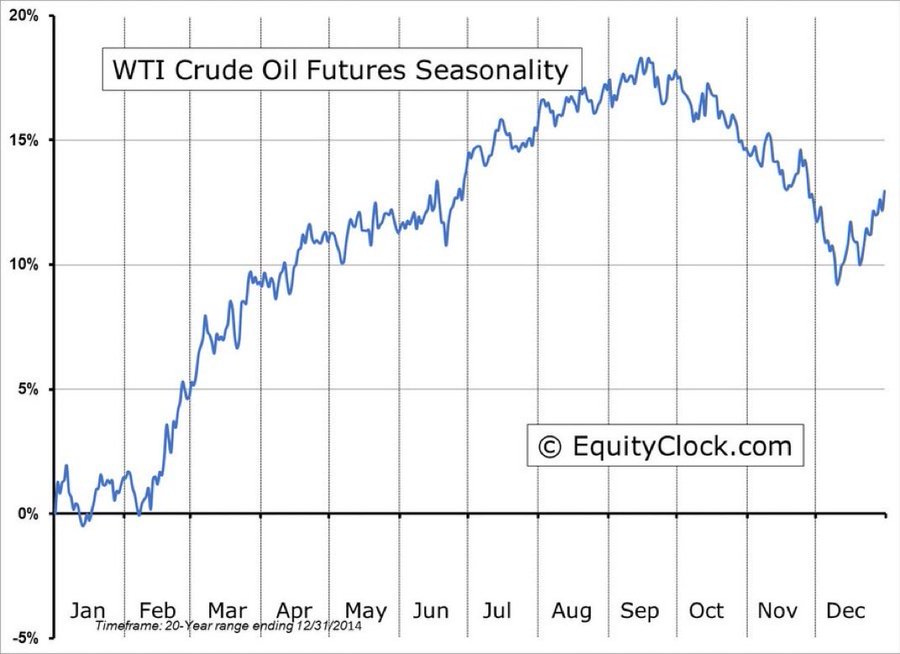

Oil: The Seasonal Inflection

Crude oil paints a mixed picture. While December often witnesses a rebound, the pace varies depending on macroeconomic conditions, inventory data, and geopolitical risks.

The yellow marker indicates where we stand now, hinting at a likely recovery from November's seasonal trough.

Historically, crude tends to rally into January, driven by colder weather and higher demand.

Pro Tip: Watch out for inventory reports and geopolitical headlines that could amplify this seasonal rally.

Dollar Weakness: The Final Chapter of the Year

Finally, the U.S. Dollar Index (DXY) demonstrates a seasonal tendency to weaken into year-end. This could act as a tailwind for dollar-denominated commodities like gold and oil.

A softer dollar reflects broader risk-on sentiment and expectations of Fed dovishness.

It also coincides with stronger performance in emerging market assets.

Implication: Dollar-sensitive trades, including long EM equities or gold, could align well with these seasonal tendencies.

Conclusion: December’s Map for Market Moves

The charts tell a consistent story: December is a month of inflection and opportunity. From gold’s rally to Bitcoin’s strength, crude’s rebound, and small-cap outperformance, there’s something for every asset class. However, the key lies in timing and diversification.

As 2024 wraps up, let these seasonal trends inform your trading playbook, but always remain nimble—markets have a way of defying even the most reliable patterns.