China Unveils $1.4 Trillion Local Government Debt Restructuring Plan

A New Phase in Fiscal Support

China’s announcement of a sweeping five-year, 10 trillion yuan ($1.4 trillion) debt restructuring plan signals a pivotal moment for local government finances and broader economic support, even as investors remain cautious. While the magnitude of the debt swap underscores Beijing’s commitment to stabilizing local finances, market reactions suggest expectations were set for more aggressive fiscal stimulus measures. This analysis dives into the details of China’s fiscal strategy, drawing on key charts that illuminate the implications of this debt restructuring for domestic and global markets.

Local Government Debt Crisis and Beijing’s Response

For years, local governments in China have shouldered increasing debt burdens, driven by ambitious infrastructure projects, real estate dependencies, and more recently, COVID-19 expenses. Beijing’s announcement represents a decisive step toward alleviating this debt pressure.

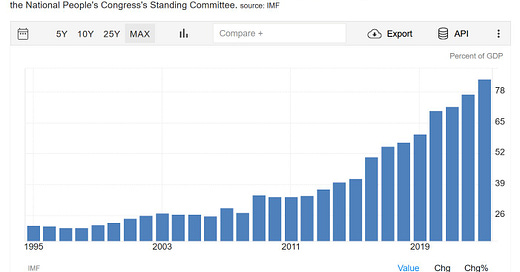

China’s Local Government Debt Growth vs. Revenue

This chart illustrates the disparity between the growth rate of local government debt and the revenue generated to service it. Debt as a percentage of GDP has surged, fueled by limited revenue streams, particularly in real estate, and exacerbated by pandemic-related costs. The debt swap proposal provides a much-needed buffer for these governments, freeing up funds for critical expenditures and potentially paving the way for stabilizing local economies.

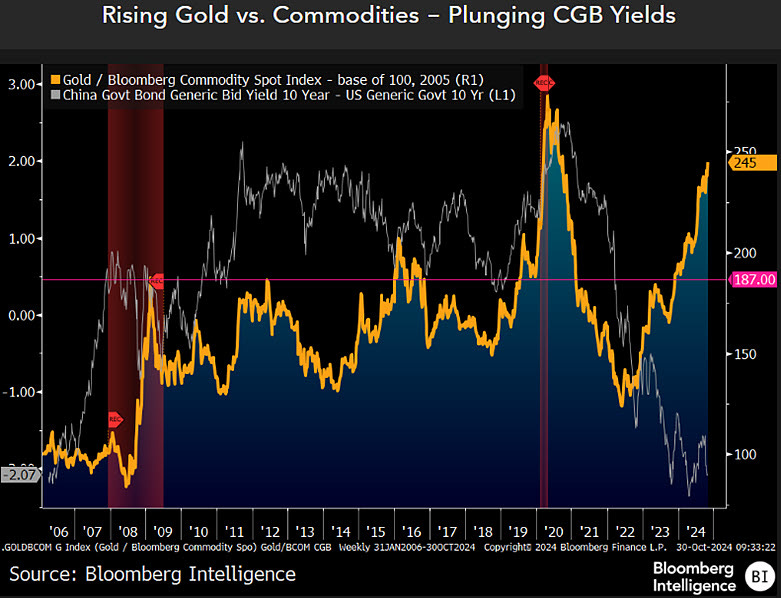

10-Year Yield Comparison: China vs. US Treasuries

A comparative look at long-term yields shows that while US Treasuries remain the benchmark for risk-free assets, Chinese government bonds have become increasingly attractive as Beijing steps in to secure local finances. The shift in yields highlights investor expectations that China's debt restructuring could reduce credit risk, even as it steers clear of direct fiscal stimulus.

Analyzing the Debt Swap Structure: Aimed at Stability, Not Stimulus

The debt swap program includes an annual issuance of 800 billion yuan in special bonds for five years, totalling 4 trillion yuan. This mechanism is targeted, seeking to ease “hidden debt” accumulated by local governments.

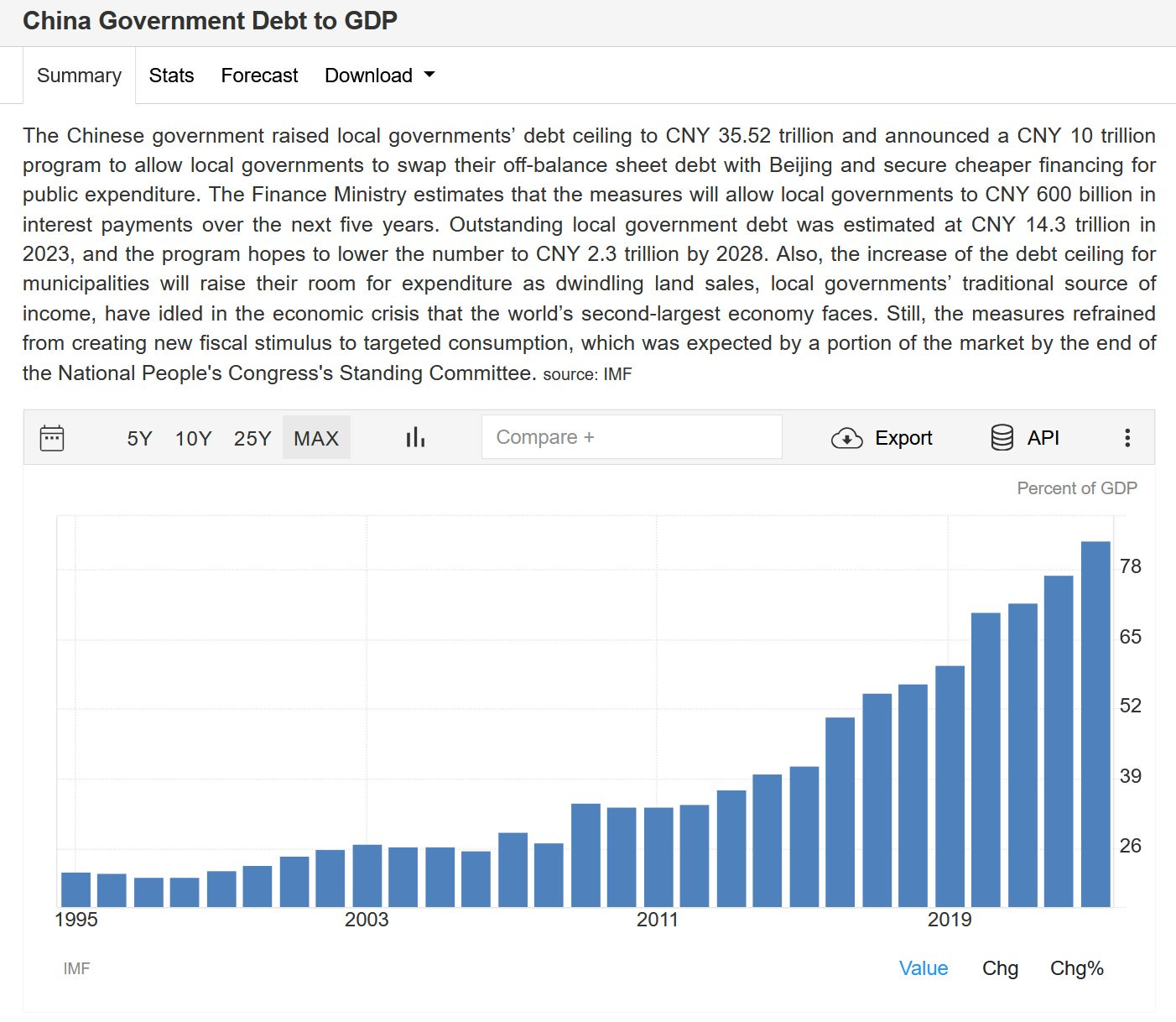

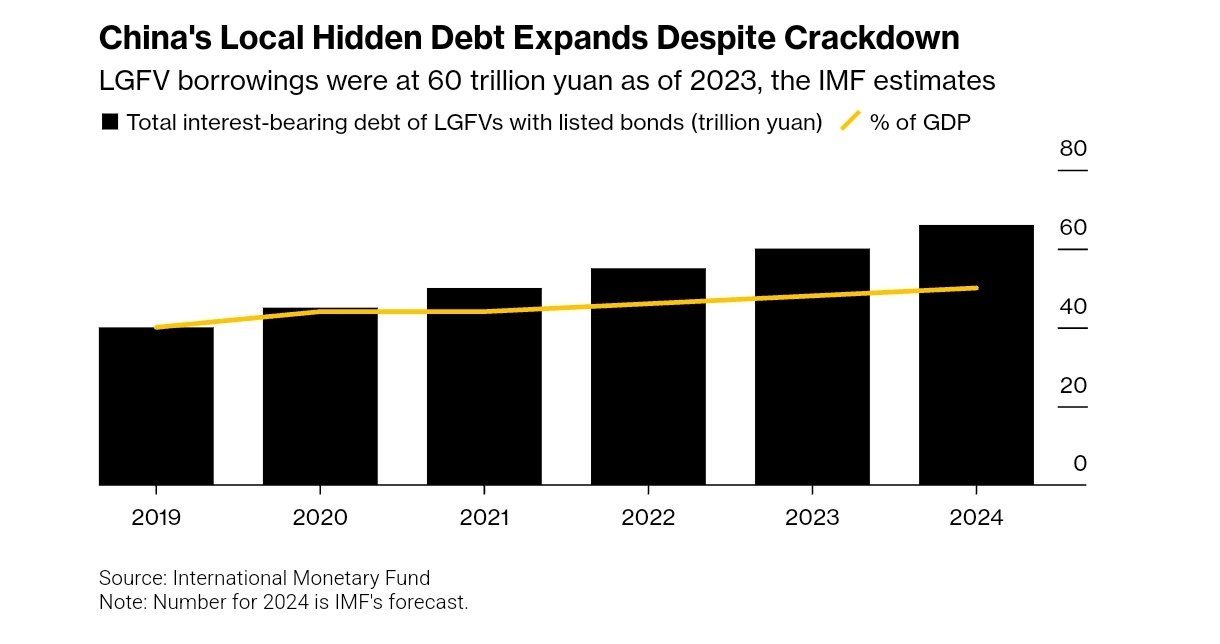

China’s Hidden Debt Reduction Projections

This chart shows projections of local governments’ hidden debt, expected to decline from 14.3 trillion yuan in 2023 to 2.3 trillion yuan by 2028. The goal is to give local authorities fiscal breathing room while minimizing disruptive credit events. Yet, the lack of direct cash injections into local economies or consumer-facing support leaves questions about the broader impact on aggregate demand.

Impact of China’s Debt Restructuring on Fiscal Space

A breakdown of projected fiscal capacity underscores Beijing's long-term strategy: stabilize rather than stimulate. By containing local debt risk, Beijing is sending a message of discipline and commitment to financial stability. However, the market’s tepid response indicates some skepticism around the program's immediate economic impact.

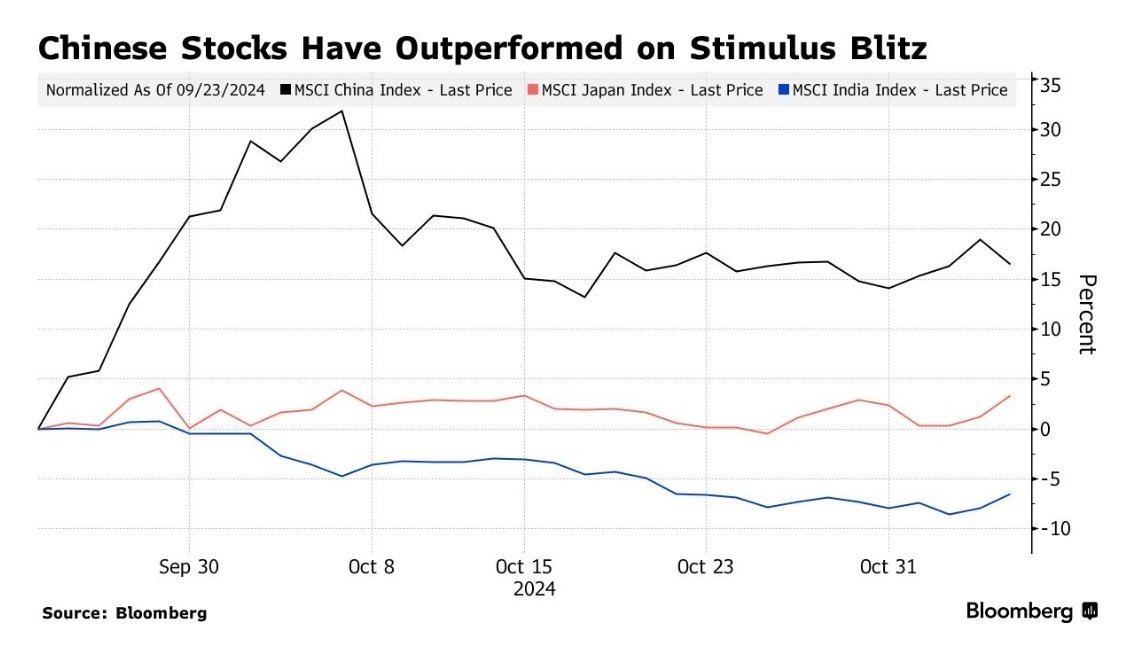

Market Reactions and the Scope for Future Stimulus

The iShares MSCI China ETF (MCHI) saw a decline of nearly 5% in premarket trading, reflecting investor disappointment over the absence of direct fiscal boosts. Although Beijing hinted at further economic support in the coming year, market participants may need to temper their expectations for aggressive stimulus in the near term, prior stimulus talks provided a boost and a subsequent drop in Chinese equities.

MCHI Performance Relative to Chinese Policy Announcements

This chart demonstrates the MCHI’s sensitivity to policy moves, particularly regarding fiscal and monetary support measures. Following the announcement, the sharp drop suggests that investors were primed for more substantial intervention, possibly akin to the support measures seen in previous economic downturns. The market's response underscores a broader sentiment: without a clear timeline for broader stimulus, Chinese equities may face continued headwinds. Now we have one.

Gold and Chinese Government Bonds vs. US Treasuries: THE TRADE