Do macro, or macro will surely do you!

My whole focus, especially over the last six months, was to highlight the ever-decelerating US economy.

Since accurately forecasting the economic peak in 2022, I've written about the epic decline in the U.S. labor force, wages, consumer prices and debt, financial conditions ex-equities and how it's impacting everday Americans.

Often labeled a “doomsdayer” much of what I underline in my writings go unnoticed, and I'm OK with that. I've been doing this a long time and trust the process.

If you don't find my process that useful, I do strongly suggest you develop your own as it will help see you through important market inflections.

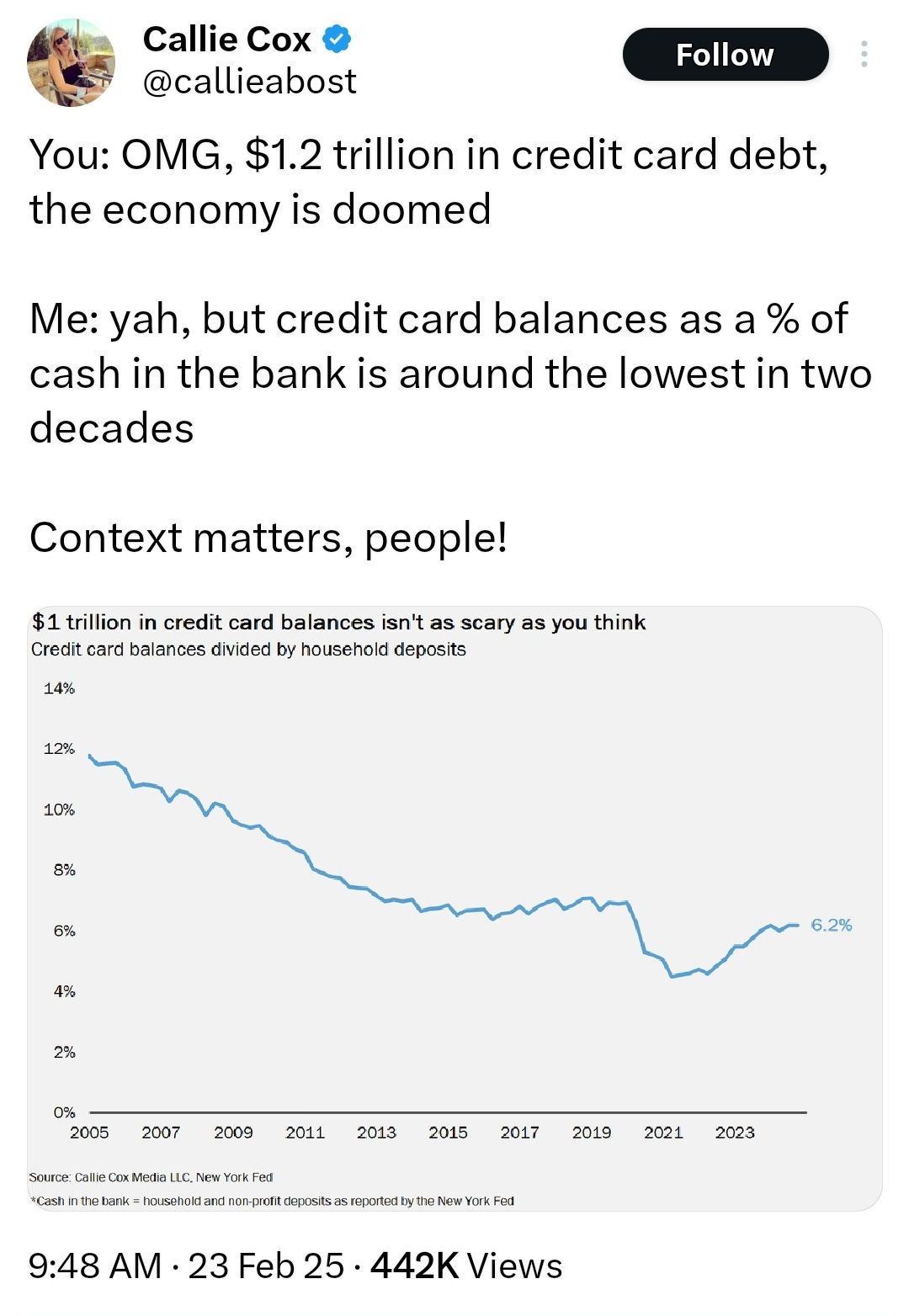

There was an interesting tweet I saw from Callie Cox of Ritholtz Wealth:

You're right Callie, context does fucking matter. The problem is that the generalized financial space created a “context” and is fitted to their own narrative.

$1tn in credit card debt, as credit card rates are at all-time highs and delinquencies at GFC highs, is a big problem.

This “cash in the bank” is not context. People with “cash in the bank” are not 30-, 60- or 90-days delinquent on their credit cards and auto loans.

People with '“cash in the bank” are able to weather slowdowns while those that don't languish and other become less wealthy as their '“cash in the bank” evaporates.

The economy deteriorates from the bottom up not the top down.

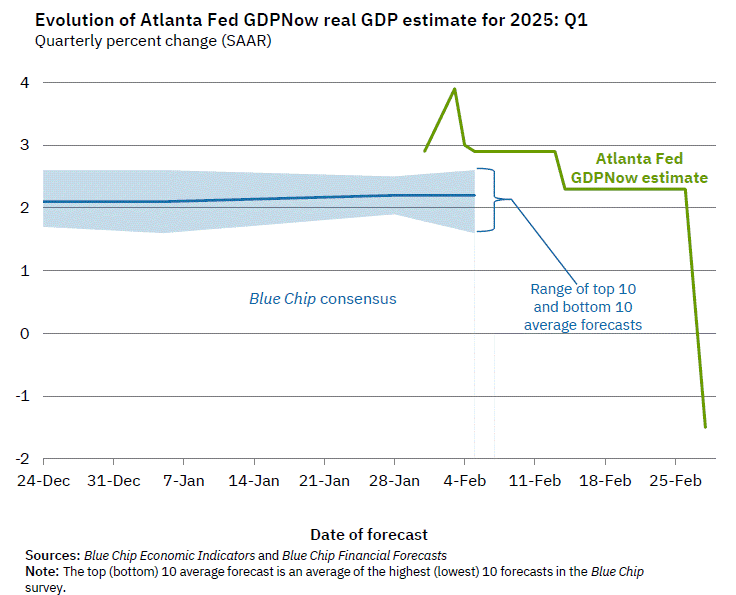

The Atlanta Fed GDPNow is now forecasting Q1-25 GDP to stand at -1.5% from its previous reading of 2.3% - a 380 bps decline. This forecast stood at 3.8% nearly a month ago!

This doesn't mean that the U.S will plunge in recession, but, on its face, does mean that the U.S. is continuing to deteriorate.

The average absolute error of its final forecasts—just prior to the release of the BEA's initial estimate—has been approximately 0.77 percentage points. This figure reflects the model's performance over a period that includes both pre-pandemic and post-pandemic economic conditions, with the latter introducing greater volatility and forecasting challenges (e.g., due to COVID-19 disruptions).

Before the pandemic (roughly 2011 to 2019), the model's accuracy was notably higher, with an average absolute error closer to 0.5 percentage points, and some analyses suggest its tracking error averaged near zero during this period when excluding extreme economic shocks.

However, during and after 2020, the error increased significantly—mean absolute errors rose to around 1.7 to 1.9 percentage points—reflecting the unprecedented economic fluctuations that made forecasting more difficult.

So, things could change. We'd have to see the underlying data change, though. Wether Q1-25 GDP finalizes in the negatives or sub-1% that's not good for everyday Americans nor is it good for risk appetite.

I want to give a big thanks to all The Macro Brief subscribers for following along, sharing and interacting with me. DMs are always open even if you have differing opinions.

Also, I want to thank Nik for his insightful additions to The Macro Brief.

You can follow me on X @The_Macro_Brief and Nik @N_I_K_Capital.